You Know More About Investing Than You Think You Do

When it comes to investing, we have all navigated uncertainty, weighed risks and rewards, and made carefully considered decisions.

When it comes to investing, we have all navigated uncertainty, weighed risks and rewards, and made carefully considered decisions.

Professional money managers have existed for centuries, but until the 1960s, there was no empirical way to hold them accountable for results.

Are crowds wise, or are they delusional? The quick answer is both, and each can play a role in our investment decisions.

The goal of this checklist is to help you become better equipped to navigate the process of selling your home.

Let’s talk about how to minimize the financial mistakes that matter the most, and make the most of the ones that remain.

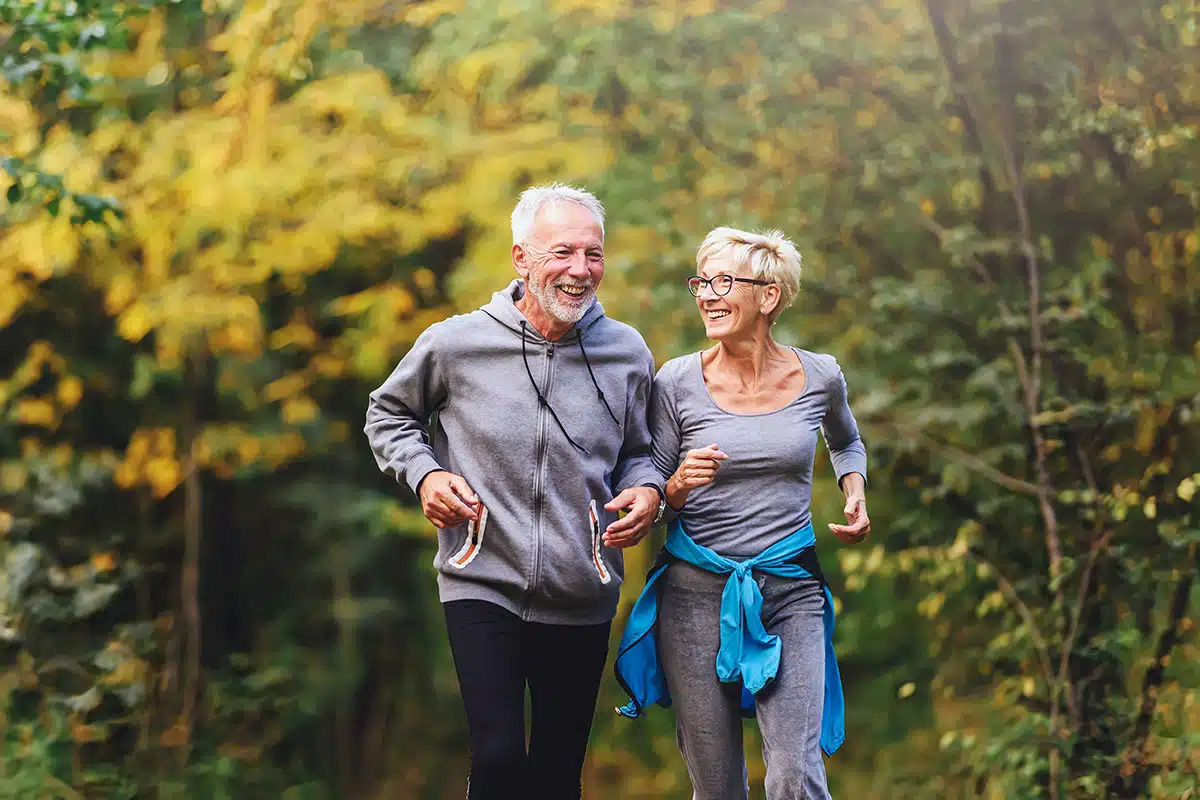

Investing and health can be two of the most important things in life, but sometimes they also can be the most confusing.

In the final installment of our stock buybacks series, let’s cover some of the potential downsides to stock buybacks.

In the latest installment of our stock buybacks series, let’s take a look at how companies use stock buybacks in practice.

Stock buybacks (i.e. company repurchasing shares of its own stock) are often targets of both praise and criticism. So, are they good or evil?

Understanding financial lingo can help you manage your money more effectively, and hold more meaningful conversations with your advisor.

Reviewing your investment portfolio is a critical part of the financial planning process. This checklist covers some key topics to consider.

There are issues to consider when buying a home, including how the costs of purchasing and owning a home will impact your financial goals.

Let’s take a look at a total return investment strategy in comparison to one that seeks more concentrated dividend stock positions.

A popular perception is dividend stocks can deliver decent returns while also creating a dependable income stream for spending in retirement.

While most people know what they should be doing, they still often fall short of properly tracking and managing cash flow.

Reviewing estate planning documents is an important exercise, but it can be a daunting task that is tedious and even confusing at times.

Can artificial intelligence help pick stocks? More specifically, can investors use AI to determine the fair price of a stock or a bond?

Compounding is the process by which the value of an investment increases over time as earnings or interest are reinvested.

So, what is going on with the U.S. debt ceiling? As potential threats loom large, we are seeing articles in abundance throughout the media.

While many people think they know more than other investors, one thing is for sure. None of us knows more than the market.

Bad things tend to happen to your personal wealth if you read, watch or listen to too much news from the financial media.

Asset location should not be confused with asset allocation. The two are related, but different, portfolio management techniques.

Many people fill out a bracket for March Madness, and you can actually find many connections between the tournament and investing.

When planning for retirement, there is one topic that is often top of mind for many people. What if Social Security goes bust?

Let’s talk about the topic of asset allocation. What exactly are assets, and what happens when you allocate them?

Rather than rummaging through your portfolio looking for trouble when headlines make you anxious, turn instead to your investment principles.

While we rarely comment on breaking news, we feel it is worth talking about the current, growing number of regional bank runs.

When it comes to calculating your true net worth, it involves a lot more than simply adding up your investment accounts and deducting money owed.

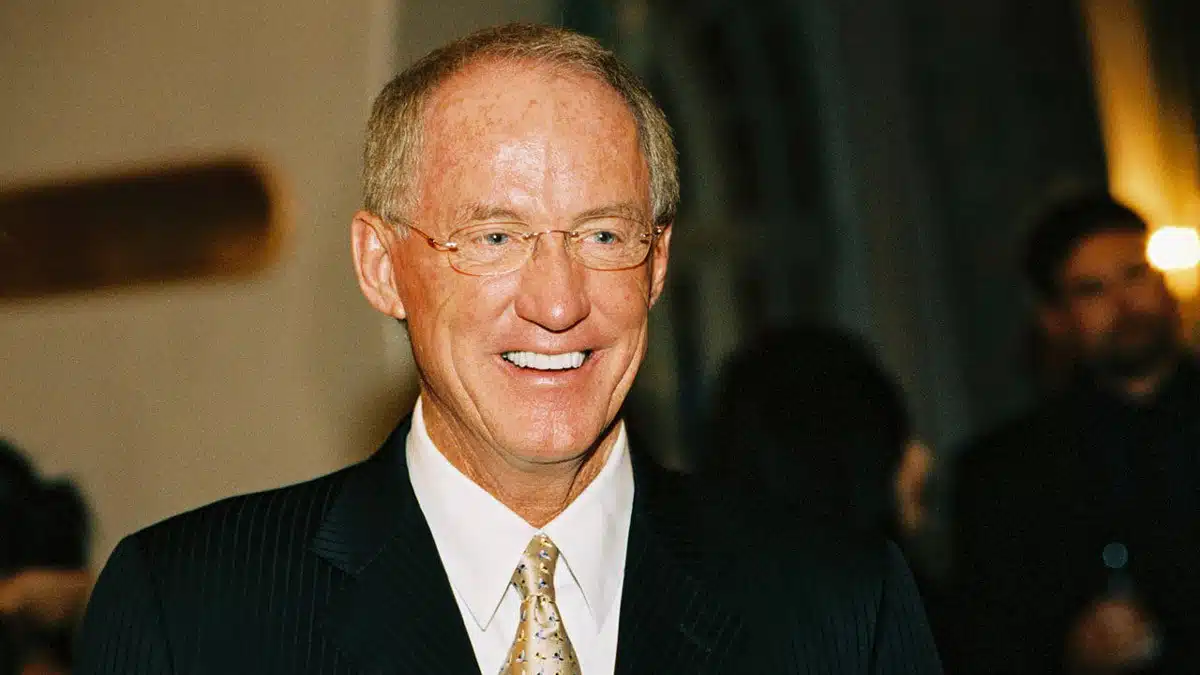

Sadly, Dan Wheeler passed away recently. To honor his memory, we want to discuss the larger-than-life butterfly effect he had on us all.

What is liquidity? When a holding is liquid, it simply means you can sell it anytime the market in which it trades is open for business.