Please know we are available for you via phone at (732) 876-3777, and we can also host virtual meetings as needed. If you would like to talk about your account or the current landscape of the markets, please do not hesitate to reach out to us at anytime.

Shore Point Advisors (SM) is located along the Jersey Shore, nestled in Brielle at the base of the Point Pleasant Bridge spanning the Manasquan River. Our team of advisors works together with clients to provide easy-to-understand recommendations and coach them on each step of implementation.

As an independent Registered Investment Advisor (RIA), Shore Point Advisors (SM) has engaged Charles Schwab to serve as custodians for our clients’ assets, providing asset protection beyond standard SIPC and FDIC coverage. Please click on the Charles Schwab logo for more information on their custody protection programs.

At Shore Point Advisors (SM), we believe investing can help most people reach their long-term financial goals. Unfortunately, many people get mixed messages and bad advice when it comes to how to invest. We provide long-term strategies to help bring clarity to the investing process.

We coach our clients and families through the sometimes confusing and overwhelming investing process. Working as a team, we can help you get on a long-term track toward reaching your financial and investing goals.

Shore Point Advisors (SM) places a strong emphasis on education, which means we can help you understand what your portfolio is doing and why. We strive to create an environment where investors are excited to attend training sessions that are designed to provide insight on the academics and scientific evidence that their investments are based upon.

Understanding the origins of your investment strategy is something few investors will ever do. However, this understanding will give you a greater depth of knowledge and can help instill confidence during uncertain market conditions. These foundations are the underpinnings that help your investment strategy work as the underlying construction of your portfolio.

Shore Point Advisors (SM) serves as an investor coach, which is a financial professional who goes beyond typical financial planning and advice to help identify your investment philosophy and understand your investment strategy. Most importantly, we provide encouragement and discipline throughout your investment experience.

We provide extensive, ongoing educational programs to help maintain investor knowledge.

Shore Point Advisors (SM) is an independent registered investment advisor, meaning we are not affiliated with a broker-dealer. As a fiduciary, we have a legal obligation to put the client’s best interests first, including before our own compensation.

We make decisions based on an academic and evidence-based investing philosophy. We offer the guidance to help make better informed decisions.

At Shore Point Advisors (SM), we subscribe to MoneyGuidePro®, which is a comprehensive financial planning program. Additionally, our clients are provided access to MoneyGuidePro® as well.

We encourage you to watch this video to learn a little more about some of the services that are offered by MoneyGuidePro®. Additionally, you can find an example scenario from MoneyGuidePro® that will help you understand how their platform looks and functions.

Shore Point Advisors (SM) adheres to three academic principles: Efficient Market Hypothesis, Modern Portfolio Theory and the Five-Factor Model. Together, these concepts form a powerful, disciplined and diversified approach to investing. The result is globally diversified portfolios comprised of more than 12,000 stocks spread across more than forty countries, designed and engineered to capture market rates of return.

A fundamental component of Free Market Investing is the Efficient Market Hypothesis, first explained by Eugene F. Fama in his 1965 doctoral thesis:

“In an efficient market, at any point in time, the actual price of a security will be a good estimate of its intrinsic value.”

– Eugene F. Fama

The stock market, the media, and popular culture, by and large, encourage behavior consistent with the belief that the market is inefficient. You must understand that there is a choice to be made about how you believe the market works.

Shore Point Advisors (SM) believes that markets are efficient, so much so that it is one of our Core Values. We focus on capturing market returns utilizing asset-class or structured funds, diversifying prudently, and eliminating stock picking, track record investing and market timing from the investment process.

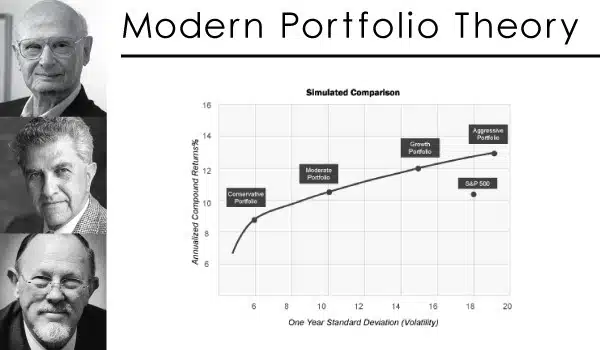

Source: Markowitz, Harry. “Portfolio Selection”. Journal of Finance, 1952

The second basic component of Free Market Portfolio Theory is Modern Portfolio Theory (MPT), which earned the Nobel Prize in Economics in 1990 for the collaborative work of Harry Markowitz, Merton Miller and William Sharpe.

Essentially, MPT demonstrates that for the same amount of risk, diversification can increase returns. The task is to find assets with an academically proven risk premium and low correlations. The Efficient Frontier allows individuals to maximize expected returns for any level of volatility.

Source: Malkiel, Burton. “A Random Walk Down Wall Street”. 1973

Fama, Eugene; French, Kenneth. “The Cross-Section of Expected Stock Returns”. Journal of Finance, 1992

Shore Point Advisors (SM) utilizes the Five-Factor Model to develop portfolios allocated between equities and fixed income, small and large equities, and value and growth equities in each of the Shore Point Advisors investment models.

The Five-Factor Model

1. The Market Factor: Pursue outperformance of stocks vs. fixed income

2. The Size Factor: Pursue outperformance of small-cap stocks over large-cap stocks

3. The Value Factor: Pursue outperformance of high book-to-market (BtM) over low BtM stocks

4. The Profitability Factor: Pursue outperformance of companies with higher future relative earnings

5. The Momentum Factor: Pursue outperformance of stocks that have risen recently tend to keep rising

Shore Point Advisors (SM) serves as an investor coach, which is a financial professional who goes beyond typical financial planning and advice to help identify your investment philosophy and understand your investment strategy. Most importantly, we provide encouragement and discipline throughout your investment experience.

Shore Point Advisors (SM) is proud to be a “New Leash on Life” Sponsor of paws4vets.

Office Location

402 Higgins Avenue

Brielle, NJ 08730

Phone: (732) 876-3777

Fax: (732) 292-1900

Email: info@shorepointadvisors.com

Days Open: Monday through Friday

Hours Open: 9:00 a.m. to 5:00 p.m.