The Core Four: The Legal Documents Everyone Should Have in Place

Learn more about the Core Four legal documents help ensure your wishes are honored if you become incapacitated.

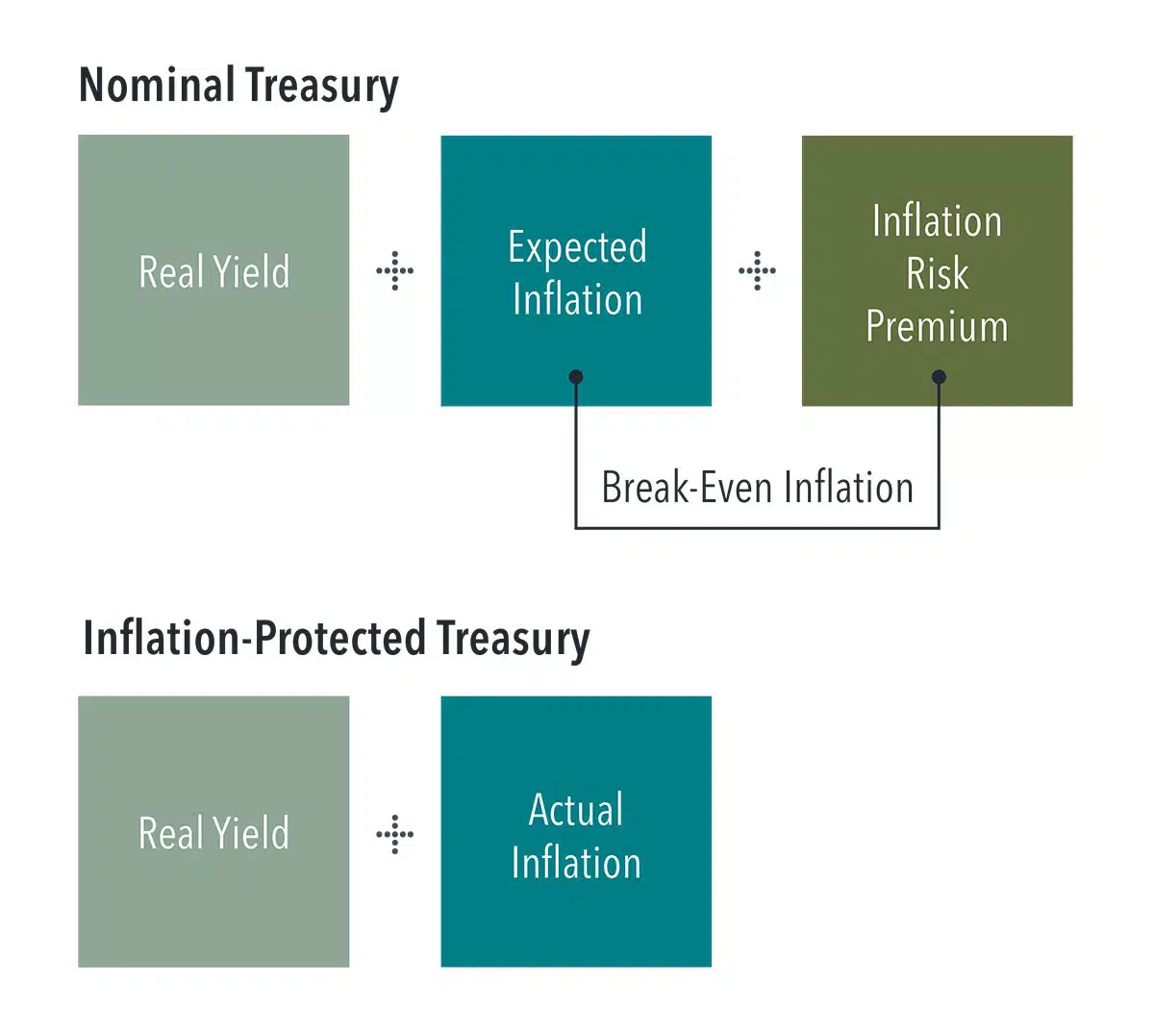

Breaking down the anatomy of inflation-protected bonds versus their nominal (non-inflation-protected) counterparts may be useful for investors weighing the tradeoffs of hedging inflation.

The first component (common to all bonds, inflation-protected or not) comes from the real yield. This is the yield before inflation expectations and depends on the current level of rates as well as the bond’s maturity.

Nominal bonds also have a component of return that includes compensation for expected inflation and a premium for bearing inflation risk. The combination of those components is often referred to as break-even inflation. Holders of nominal bonds will break even for the inflation contribution if actual inflation ends up equivalent to the break-even measure.

However, actual inflation sometimes meaningfully deviates from expectations. Inflation-protected securities hedge the risk of unexpected inflation by replacing the expected inflation and risk premium components with a payment for actual inflation. Whether this tradeoff is positive or negative depends on how actual inflation compares to break-even inflation. All else being equal, if actual inflation is greater than break-even inflation, the real return would be higher with the inflation-protected security. The opposite would be true if actual inflation ends up being less than break-even inflation.

This article originally appeared in Above the Fray, a weekly newsletter for Dimensional clients.

DISCLOSURES

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

DISCLAIMER

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Learn more about the Core Four legal documents help ensure your wishes are honored if you become incapacitated.

There are issues to consider when buying a home, including how the costs of purchasing and owning a home will impact your financial goals.

Use this cash flow checklist to review income, expenses, debt, taxes, and savings strategies that support long-term planning.

Should you consolidate retirement accounts? Learn the benefits, potential drawbacks, and key factors to consider before making a move.