What Is Asset Location?

Asset location should not be confused with asset allocation. The two are related, but different, portfolio management techniques.

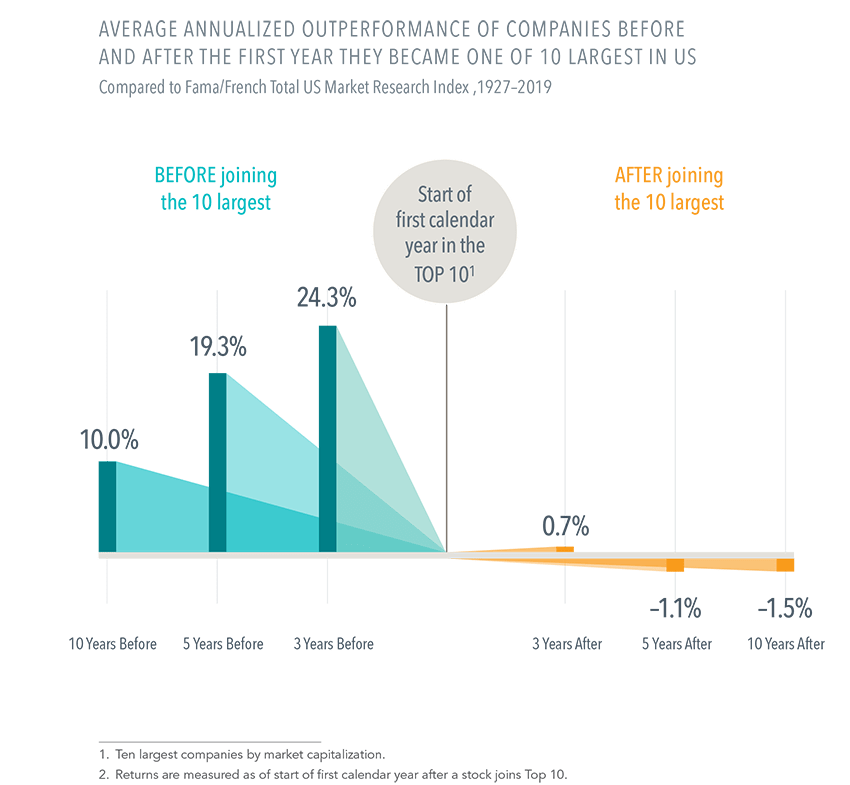

Why Investors Might Think Twice About Chasing the Biggest Stocks

As companies grow to become some of the largest firms trading on the US stock market, the returns that push them there can be impressive. But not long after joining the Top 10 largest by market cap, these stocks, on average, lagged the market.

Expectations about a firm’s prospects are reflected in its current stock price. Positive news might lead to additional price appreciation, but those unexpected changes are not predictable.

This post was prepared and first distributed by Dimensional Fund Advisors.

Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

Asset location should not be confused with asset allocation. The two are related, but different, portfolio management techniques.

From new deductions to IRA deadlines, understand the 2025 tax updates that could affect your return and planning strategy.

Since 1926, the US stock market has rewarded investors with an annualized return of about 10%.

Understand asset allocation and how a diversified portfolio helps manage risk and support long-term financial goals.