The Core Four: The Legal Documents Everyone Should Have in Place

Learn more about the Core Four legal documents help ensure your wishes are honored if you become incapacitated.

Jake Rue, MBA, RICP®, AIF®, AAMS® | Advisor & Portfolio Manager at Shore Point Advisors

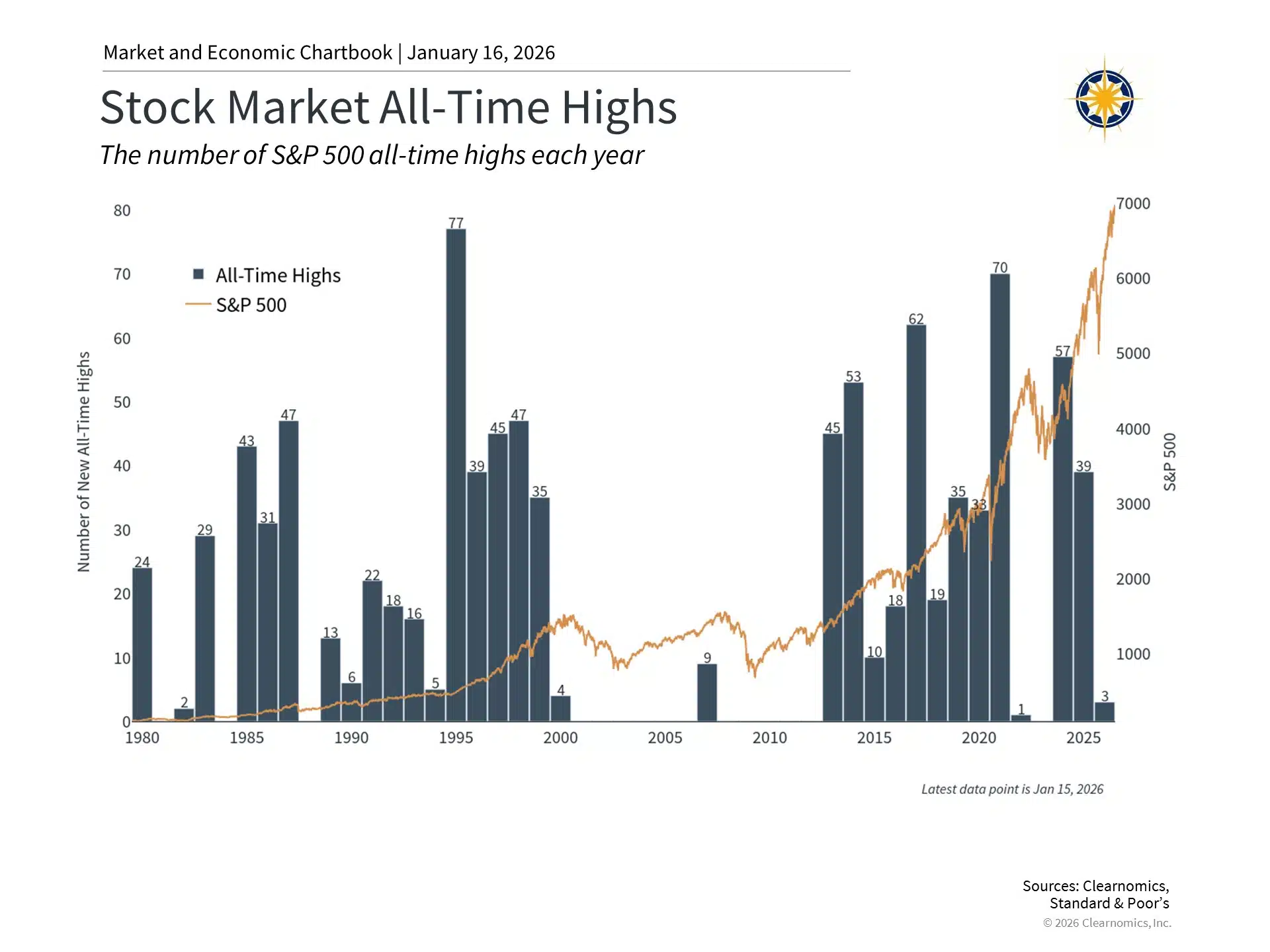

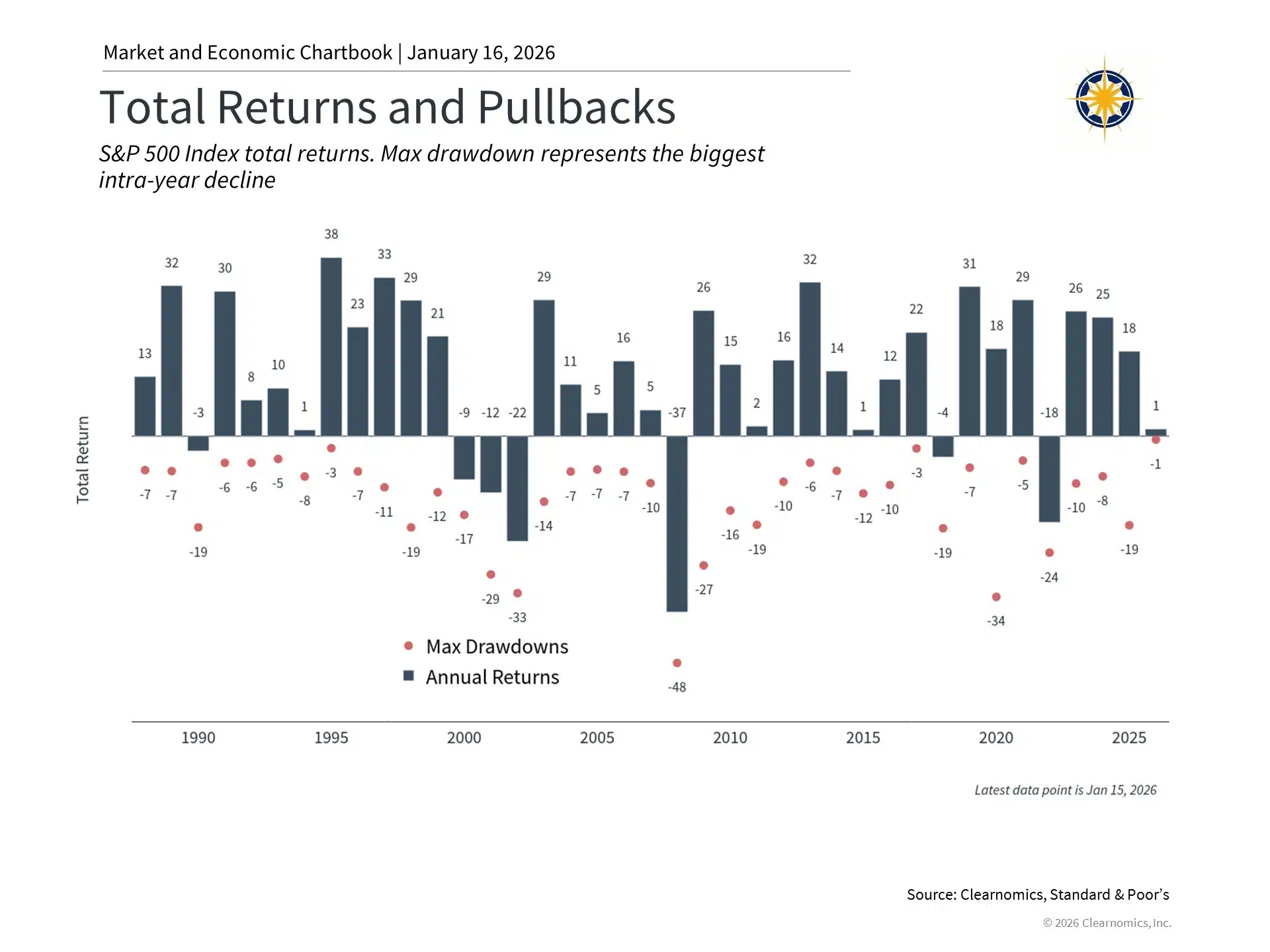

2025 was a very strong year for the stock market. Many important events happened during the year, including new tariff policies in April, developments in artificial intelligence (AI) technology, and the passing of a new tax bill called the One Big Beautiful Bill Act. Despite these events, U.S. stocks reached new record highs, international markets did well, and bonds continued to recover from earlier losses. The S&P 500 (an index that tracks 500 large U.S. companies) has now had gains of more than 10% in six of the past seven years.

This past year shows us that staying patient and focused on long-term goals is the best way to handle uncertainty in markets. As we move into 2026, understanding what happened in 2025 can help guide our decisions going forward.

Here are some key numbers from 2025:

Many of the events in 2025 were things investors expected might happen, even if they didn’t know exactly when or how. For example, investors knew President Trump might implement tariffs (fees on imported goods), that the Federal Reserve (the Fed) might lower interest rates, and that a new tax bill might pass.

Because investors were somewhat prepared for these events, markets were able to recover quickly after temporary declines. For instance, when large tariffs were announced in April, the market dropped but then bounced back once investors understood the full impact.

Here are some of the most important market events from 2025:

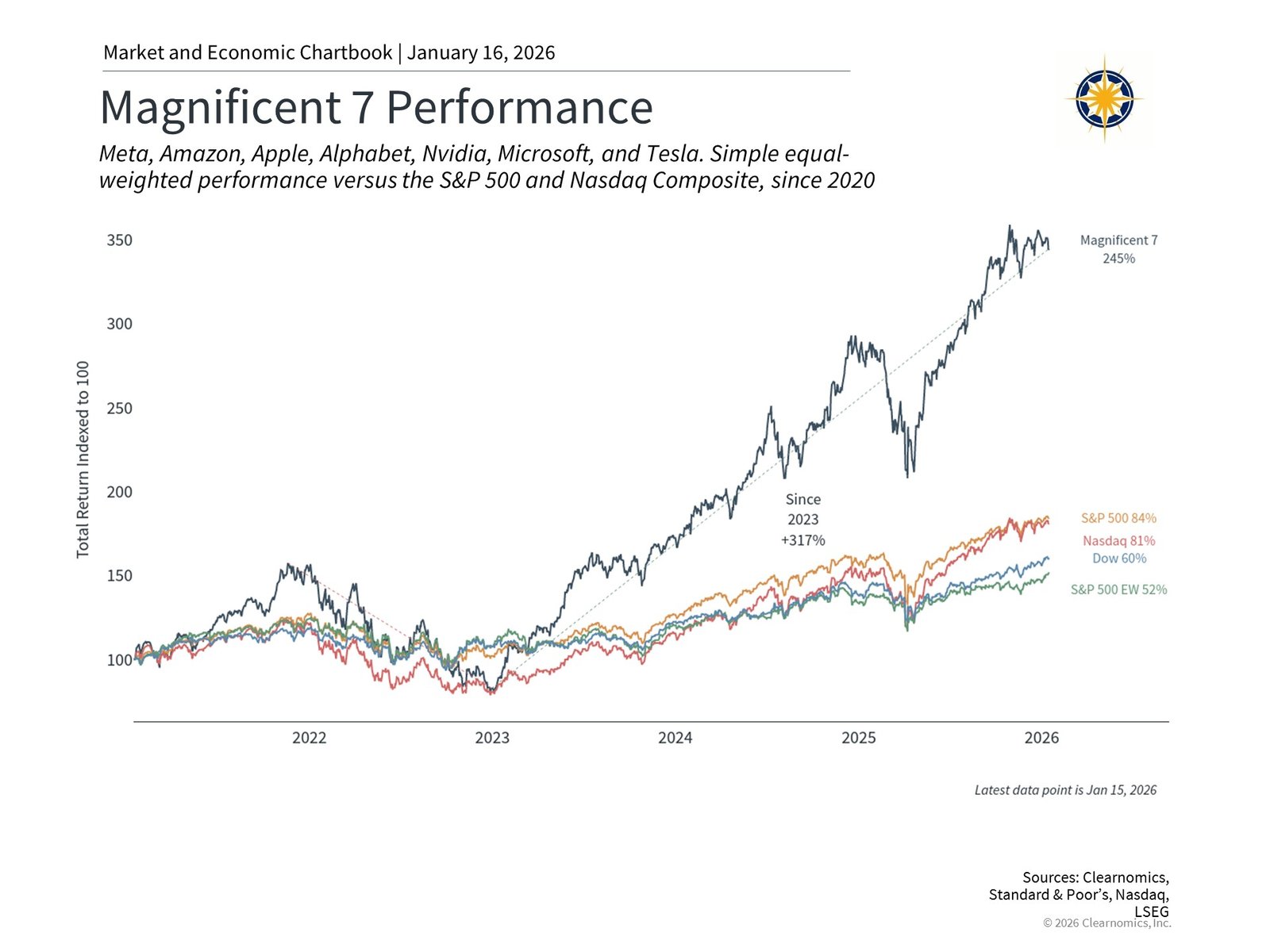

First, artificial intelligence was a major driver of market performance. The largest technology companies (sometimes called the Magnificent 7) now make up about one-third of the S&P 500. This means most investors have significant exposure to these companies and AI technology, whether they realize it or not.

Second, tariffs created uncertainty but had less economic impact than many feared. While tariffs increased, companies adapted and consumer spending stayed strong. This shows that policy changes don’t always affect the economy or markets in obvious ways.

Third, many different types of investments performed well in 2025. International stocks outperformed U.S. stocks, bonds had strong returns, and gold reached record highs. Having a diversified mix of investments (called asset allocation) helped investors benefit from these different opportunities.

The bottom line? 2025 was a strong year for investors. The key lesson is to stay disciplined and focused on your long-term goals, which remains important as we move into 2026.

DISCLAIMERS

The content of this material was produced by Clearnomics and amended by Shore Point Advisors. Content should not be regarded as a complete analysis of the subjects discussed. Although we believe the content is reliable, it is not guaranteed as to accuracy and does not purport to be complete nor is it intended to be the primary basis for investment decisions.

This material is intended for general public use. By providing this material, we are not undertaking to provide investment advice for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact one of our financial professionals for guidance and information specific to your individual situation. This is not an offer to buy or sell a security.

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Learn more about the Core Four legal documents help ensure your wishes are honored if you become incapacitated.

There are issues to consider when buying a home, including how the costs of purchasing and owning a home will impact your financial goals.

Use this cash flow checklist to review income, expenses, debt, taxes, and savings strategies that support long-term planning.

Should you consolidate retirement accounts? Learn the benefits, potential drawbacks, and key factors to consider before making a move.