The Core Four: The Legal Documents Everyone Should Have in Place

Learn more about the Core Four legal documents help ensure your wishes are honored if you become incapacitated.

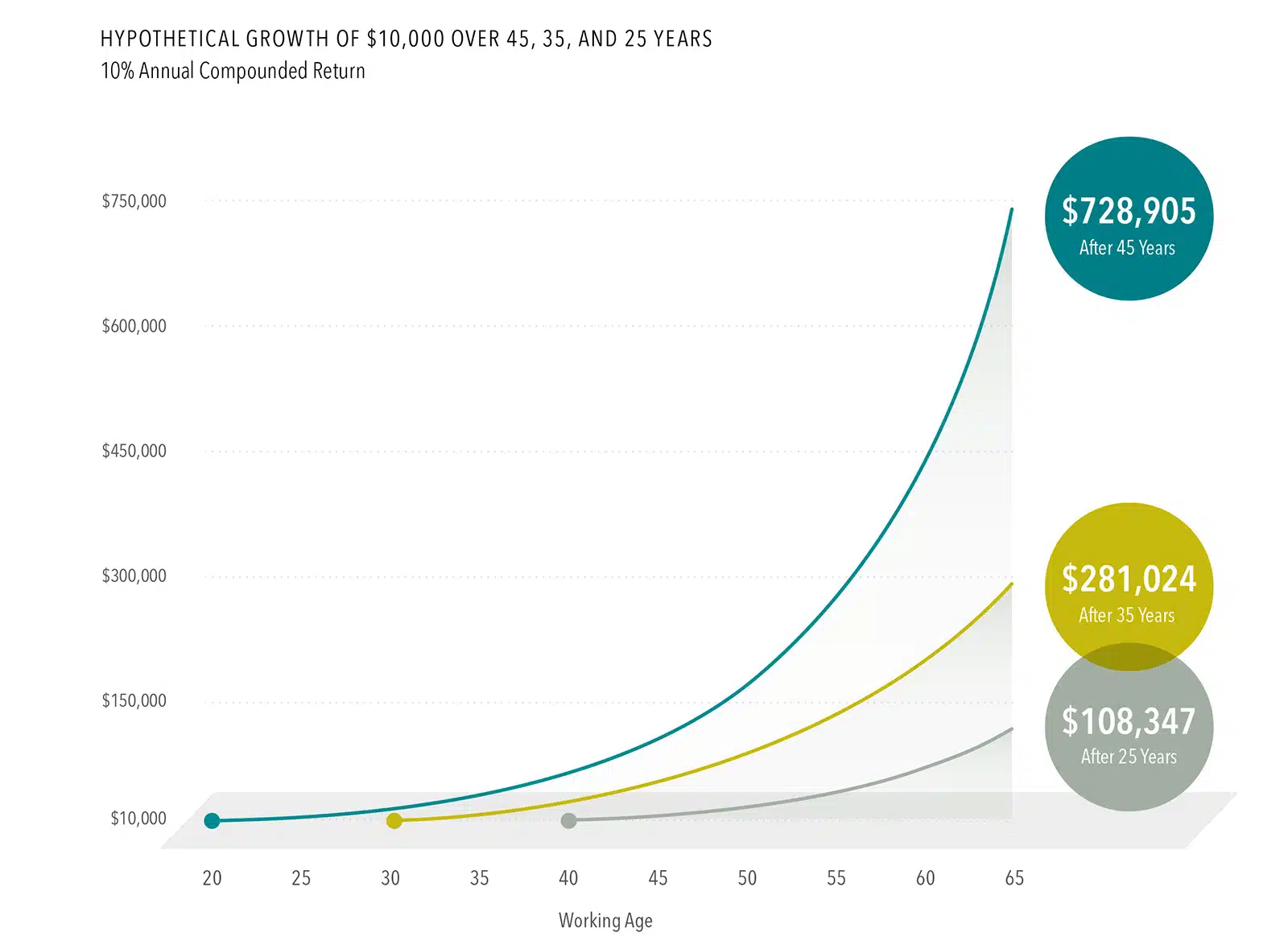

Compounding is a powerful force. When returns are reinvested, the investment’s value can grow exponentially over time.

Compounding can help turn a small investment into substantial wealth. But to harness that power, the sooner you start, the better.

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful.

In USD. For illustrative purposes only. S&P 500 Index annualized return January 1926–December 2025 is 10.42%. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value Dimensional Fund Advisors does not have any bank affiliates.

This post was written and first distributed by Dimensional Fund Advisors.

DISCLAIMER

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Learn more about the Core Four legal documents help ensure your wishes are honored if you become incapacitated.

There are issues to consider when buying a home, including how the costs of purchasing and owning a home will impact your financial goals.

Use this cash flow checklist to review income, expenses, debt, taxes, and savings strategies that support long-term planning.

Should you consolidate retirement accounts? Learn the benefits, potential drawbacks, and key factors to consider before making a move.