Dissecting Inflation Protection

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

The end of the year presents a number of planning opportunities and potential financial discussions. Year-end topics can include tax planning, investment and retirement accounts, charitable giving, cash flow and savings, insurance and estate planning.

On this blog post, we cover various planning issues you may need to consider prior to year-end in order to stay on track, including:

Do you have unrealized investment losses in your taxable accounts?

If so, consider realizing losses to offset any gains and/or write off up to $3,000 against ordinary income.

Do you have investments in taxable accounts that are subject to end-of-year capital gain distributions?

If so, consider strategies to minimize tax liability.

Are you subject to taking RMDs (including from inherited IRAs)?

If so, consider the following:

Do you expect your income to increase in the future?

If so, consider the following strategies to minimize your future tax liability:

Do you expect your income to decrease in the future?

If so, consider strategies to minimize your tax liability now, such as traditional IRA and 401(k) contributions instead of contributions to Roth accounts.

Do you have any capital losses for this year or carryforwards from prior years?

If so, consider the following:

Are you on the threshold of a tax bracket?

If so, consider strategies to defer income or accelerate deductions and strategies to manage capital gains and losses to keep you in the lower bracket.

Consider the following important tax thresholds:

Are you charitably inclined?

If so, consider the following:

Will you be receiving any significant windfalls that could impact your tax liability (inheritance, RSUs vesting, stock options, bonus)? If so, review your tax withholdings to determine if estimated payments may be required.

Do you own a business?

If so, consider the following:

Have there been any changes to your marital status?

If so, consider how your tax liability may be impacted based on your marital status as of December 31st.

Are you able to save more?

If so, consider the following:

Do you want to contribute to a 529 account?

If so, consider the following:

Will you have a balance in your FSA before the end of the year?

If so, consider the following options your employer may offer:

Did you meet your health insurance plan’s annual deductible?

If so, consider incurring any additional medical expenses before the end of the year, after which point your annual deductible will reset.

Have there been any changes to your family, heirs, or have you bought/sold any assets this year?

If so, consider reviewing your estate plan. See “What Issues Should I Consider When Reviewing My Estate Planning Documents?” checklist for details.

Are there any gifts that still need to be made this year?

If so, gifts up to the annual exclusion amount of $17,000 (per year, per donee) are gift tax-free.

Do you have children in high school or younger who plan to attend college?

If so, consider financial aid planning strategies, such as reducing income in specific years to increase financial aid packages.

Will new laws go into effect next year that may impact your overall financial plan?

This checklist was prepared and first distributed by fp PATHFINDER.

DISCLAIMERS

This material is intended for general public use. By providing this material, we are not undertaking to provide investment advice for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact one of our financial professionals for guidance and information specific to your individual situation. This is not an offer to buy or sell a security.

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

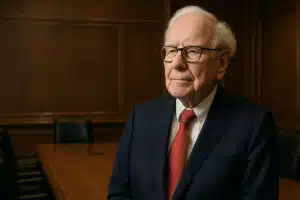

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.

Asset allocation plays an important role in an investment portfolio.

Compounding is a powerful force. When returns are reinvested, the investment’s value can grow exponentially over time.