Dissecting Inflation Protection

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

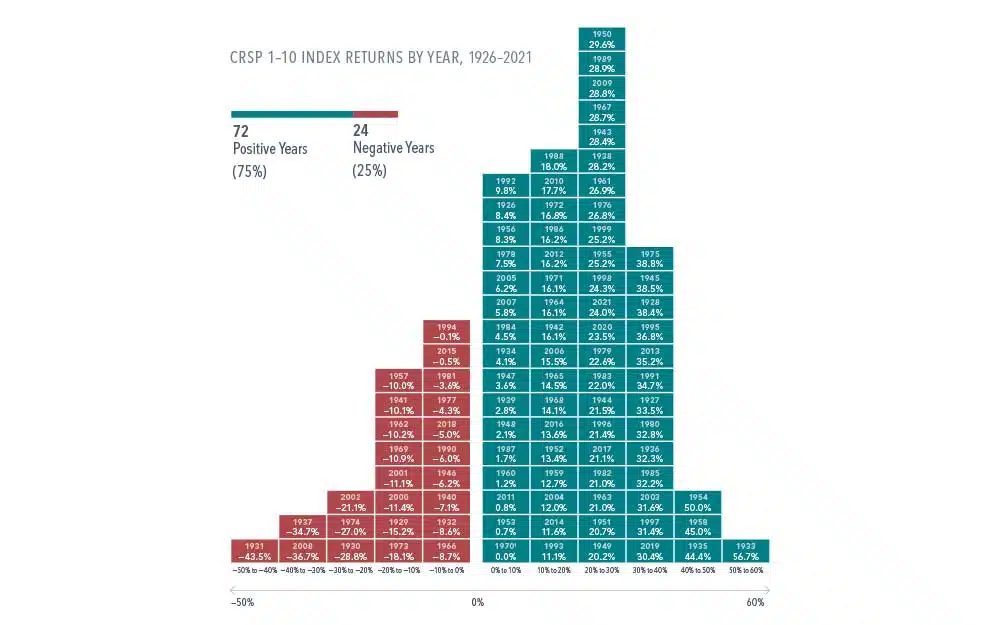

Annual stock market returns are unpredictable, but “up” years have occurred much more frequently than “down” years in the United States. That may be reassuring to investors, especially if they find market downturns unsettling.

The stock market tends to reward investors who can weather annual ups and downs and stay committed to a long-term plan.

IMPORTANT DISCLOSURES

This report was first published by Dimensional Fund Advisors LP, an investment advisor registered with the Securities and Exchange Commission.

Past performance is no guarantee of future results. Actual returns may be lower. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

In US dollars. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.

Asset allocation plays an important role in an investment portfolio.

Compounding is a powerful force. When returns are reinvested, the investment’s value can grow exponentially over time.