How to Have Family Conversations About Money

Talking about money does not have to be uncomfortable. Learn how to have productive financial conversations with your family.

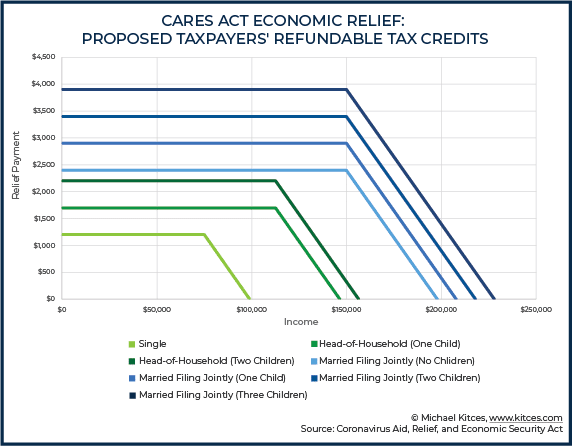

With much of the country in self-isolation, perhaps you’ve had time to read the entire H.R. 748 Coronavirus Aid, Relief, and Economic Security Act, or CARES Act. If you’d prefer, here is a summary of many of the key provisions we expect to be discussing with you in person (virtually), depending on which ones apply to you. If you have any questions after reading this, give us a call at (732) 876-3777.

Now you’re caught up on the critical content of the CARES Act. That said, given the complexities involved and unprecedented current conditions, there will undoubtedly be updates, clarifications, additions, system glitches, and other adjustments to these summary points. The results could leave a wide gap between intention and reality.

As such, before proceeding, please consult with us and other appropriate professionals, such as your accountant, and/or estate planning attorney on any details specific to you. Please don’t hesitate to reach out to us with your questions and comments. It’s what we’re here for.

This post was prepared and first distributed by Wendy J. Cook.

Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

Talking about money does not have to be uncomfortable. Learn how to have productive financial conversations with your family.

What is liquidity? When a holding is liquid, it simply means you can sell it anytime the market in which it trades is open for business.

Learn how the 80/20 Rule can simplify investing, planning and financial decisions by focusing on the actions that matter most.

2025 was a very strong year for the stock market. Many important events happened during the year.