Issues to Consider When Reviewing Cash Flow

Use this cash flow checklist to review income, expenses, debt, taxes, and savings strategies that support long-term planning.

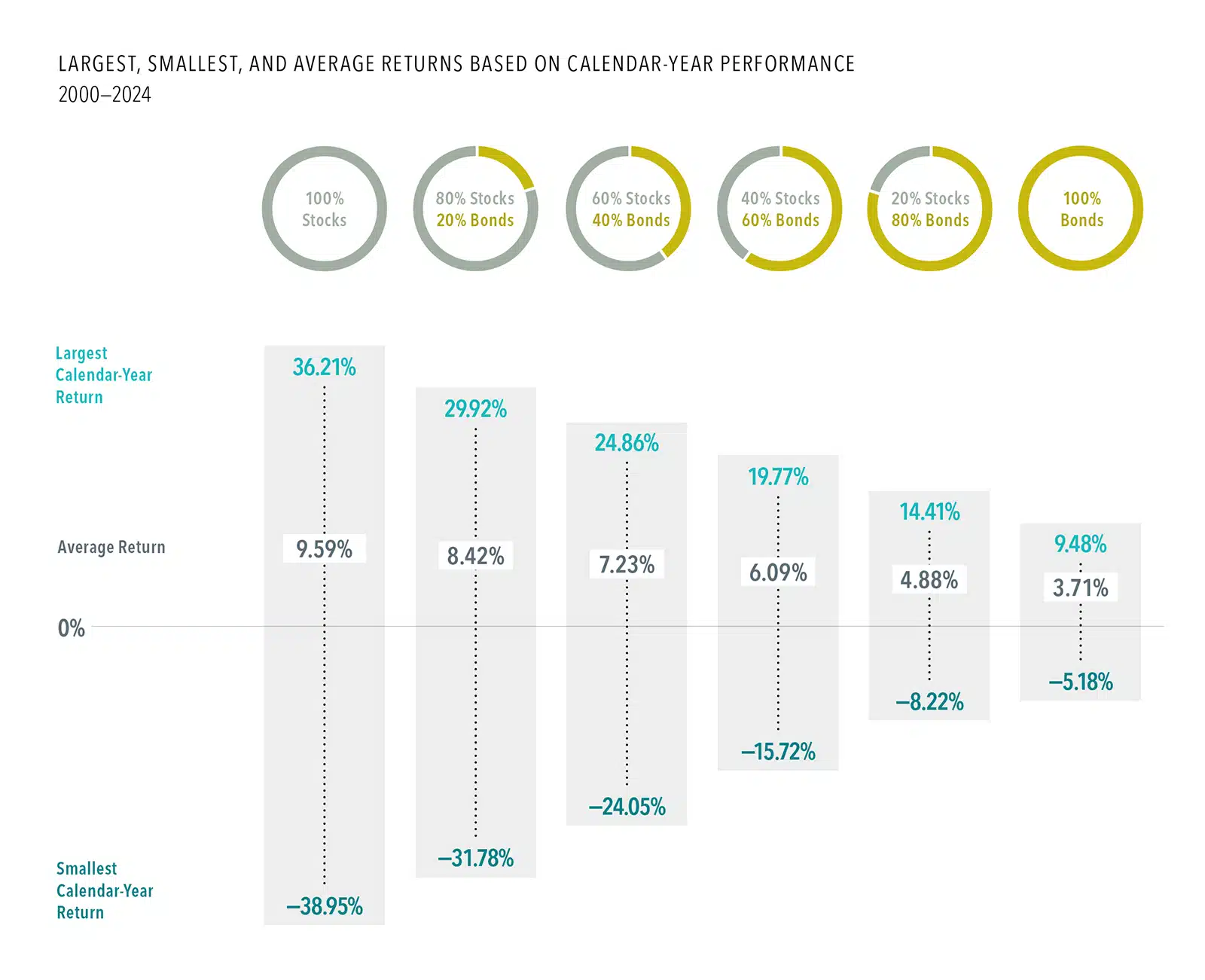

Asset allocation plays an important role in an investment portfolio. For example, the proportion of stocks versus bonds can have a big impact on risk and return.

When choosing an asset allocation for your portfolio, it is important to understand how stock and bond exposure impacts risk and return.

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful.

In USD. Weights as of December 31, 2024. Rebalanced monthly. Totals may not equal 100% due to rounding. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg data provided by Bloomberg.

Performance results of the asset allocations are based on performance of indices with backtested performance results; the performance was achieved with the benefit of hindsight; it does not represent actual investment strategies. The allocation’s performance does not reflect advisory fees or other expenses associated with the management of an actual portfolio. There are limitations inherent in asset allocations. In particular, performance may not reflect the impact that economic and market factors may have had on the advisor’s decision-making if the advisor were actually managing client money.

The Dimensional indices have been retrospectively calculated by Dimensional Fund Advisors LP and did not exist prior to their index inception dates. Accordingly, results shown during the periods prior to each index’s inception date do not represent actual returns of the index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains.

The Dimensional indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

This post was written and first distributed by Dimensional Fund Advisors.

DISCLAIMER

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Use this cash flow checklist to review income, expenses, debt, taxes, and savings strategies that support long-term planning.

Should you consolidate retirement accounts? Learn the benefits, potential drawbacks, and key factors to consider before making a move.

Reviewing estate planning documents is an important exercise, but it can be a daunting task that is tedious and even confusing at times.

Explore the role of financial media in investing and how to avoid emotional, headline-driven decisions.