10 Ways Every Entrepreneur Can Adopt an Investing Mindset

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

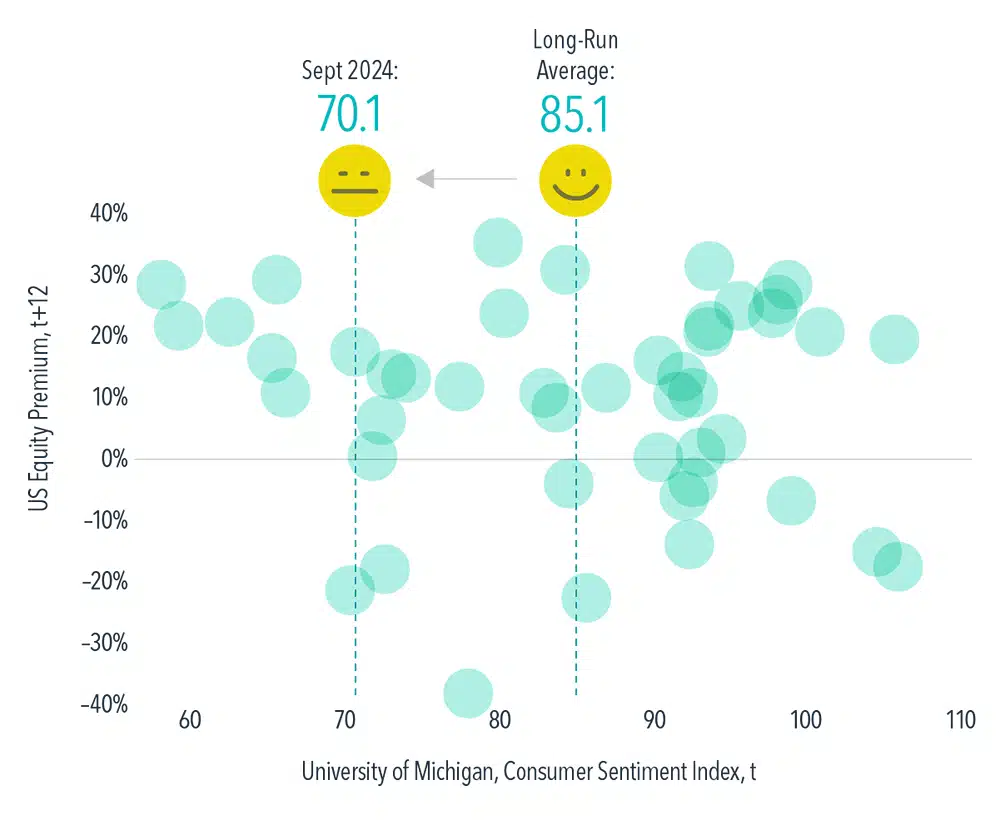

Does your neighbor know where the economy is headed in the next 12 months? Since the 1960s, the University of Michigan has published the popular Consumer Sentiment Index, which asks everyday folks questions like: “Are you better off or worse off financially than you were a year ago?” or “Do you think that a year from now you will be better off financially, worse off financially, or just about the same as now?” (1) This index is sometimes viewed as a beacon of how investors feel about the direction of the economy.

As of September 30, 2024, the index sat at 70.1, pessimistic relative to its long-run average of 85.1. (2) Investors interpreting this as an ominous sign for markets may not have anything to fear though, as the data show this index has not been great at predicting future returns. Plotting the level of the Consumer Sentiment Index against subsequent 12-month stock market returns shows no discernible pattern, except that stocks tend to go up more often than they go down. Out of the 226 months where the sentiment index was below the long-run average, the average equity premium over the next year was 10.6%.

If your neighbor is feeling sour, that does not necessarily mean you should be changing your outlook or your investment portfolio. Markets tend to price in the latest views on the economy, including consumer optimism.

December 1978–December 2023

Past performance is not a guarantee of future results.

In USD. Source: “Surveys of Consumers,” University of Michigan, University of Michigan: Consumer Sentiment ©, retrieved from FRED, Federal Reserve Bank of St. Louis, October 28, 2024. US Equity Premium represented by returns to the Fama/French Total US Market Research Index minus the returns to one-month US Treasury bills. Data provided by Fama/French. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. See “Index Descriptions” for descriptions of Fama/French index data. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

This article originally appeared in Above the Fray, a weekly newsletter for Dimensional clients.

INDEX DESCRIPTIONS

Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Ken French website.

Results shown during periods prior to each index’s inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains.

FOOTNOTES

(1) “Surveys of Consumers,” The Regents of the University of Michigan, 2024. All rights reserved.

(2) Current index level as of September 30, 2024. The date range for the long-run monthly average is December 1978–December 2023.

DISCLOSURES

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

DISCLAIMER

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.