10 Ways Every Entrepreneur Can Adopt an Investing Mindset

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

In selecting or retaining a financial advisor, how do you know if you are making a wise choice?

So, how do you recognize good financial advice in a crowded field of look-alikes?

First, to summarize what we have covered so far in this series, here is a handy checklist you can use to narrow down your search.

A Checklist for Identifying an Ideal Advisor

Relationship | Your advisor’s sole, continuous duty should be to advance your highest financial interests (even ahead of their own). |

Primary Role | Your advisor should deeply understand and account for your total wealth interests, and advise you accordingly, in a fiduciary capacity across your entire relationship. |

Employment Status | As a fully independent Registered Investment Advisor firm, your advisor’s only “boss” should be investor clients like you. |

Compensation | Your advisor’s compensation should be fee-only, so their only financial incentives come from investor clients like you. |

Investment Plan | First, it’s essential to have a plan. It should be grounded in evidence over emotion, structured to manage all your investments in unity, and tailored to patiently capture expected returns according to your personal goals and risk tolerance. |

Custody of Assets | Your investment accounts should be held by an independent custodian who reports directly to you. |

Conflicts of Interest | Your advisor should minimize any conflicts of interest by embracing all of the above best practices – not only when they’re required, but because they’re the right things to do. |

Checklist in hand, any reputable advisor should relish your deep, candid questions, no matter how detailed or direct they may be. If the response seems incomplete, confusing, defensive or otherwise lacking, this may indicate a poor fit, even if everything else checks out fine.

Here are three good questions that cover a lot of ground:

1. Will your relationship with me be only and always as my fiduciary advisor? Take no less than an unqualified “yes,” with no ifs, ands or buts.

2. Can the same be said for your entire firm and its full range of services? Some firms may have a mixture of services, with employees who are dually registered. This means some of their services are dispensed with broker/dealer hats on, while other times they are acting as your advisor. It may be unclear when and whether they are working for you or their employer.

3. Will you and your firm agree to a fiduciary relationship in writing? How reliable are verbal assurances if you cannot get them in plain writing? For example, here are three sources for simple but powerful language you can use to craft a fiduciary oath. In our estimation, any advisor worth heeding should be willing and able to sign such an oath.

The financial industry is highly regulated, with required disclosures to describe a firm’s conflicts of interest, how they are compensated, whether they have had past “incidents,” and more.

Since these reports exist, we highly recommend taking advantage of them.

Form ADV: Whether registered with their state or the SEC, Registered Investment Advisor firms of any size must file a Form ADV, found on the SEC’s Investment Adviser Public Disclosure website. The firm’s ADV “Part 2 Brochure” is a good place to start, since the rest of the ADV tends to be more technical. (Here is a link to our own Form ADV Part 2 Brochure.)

FINRA BrokerCheck: Most advisors should also be listed in FINRA’s BrokerCheck, where additional details and disclosures may be found. (Although the name suggests it is a repository for broker disclosures, the resource actually reports on both advisors and broker/dealers.)

Form CRS: Many firms must also now publish a Client Relationship Summary, or Form CRS, with additional, simplified disclosures. Under Reg BI, there are two groups who must file these: (1) Broker/dealers offering incidental investment recommendations and (2) Registered Investment Advisor firms registered with the SEC.

Most smaller, state-regulated advisors are not yet required to do so. A firm’s Form CRS should be available on its website, or you can request a copy of the same. Here is a link to the Shore Point Advisors Form CRS.

Professional Affiliations: Does an advisor hold professional credentials, such as a CFP® mark? Some organizations provide consumer-facing reports on their membership.

Google: You can also deploy your favorite search engine to see what the virtual world has to say about an advisor and their firm. Especially if a name is relatively common, make sure you have accurate hits. And remember, some sources will be far more reputable than others.

So, in selecting a financial advisor, how do you know if you are making a wise choice?

First, make sure they will uphold a fiduciary duty to you across your entire relationship, and will agree to that in writing. Use our checklist to determine whether the advisor is well-positioned to sit on your side of the table.

Also review their background, asking critical questions. Take advantage of the advisor’s Form ADV, Form CRS and other resources to facilitate your due diligence.

Beyond that, look for someone you get along with on a personal level. If you and your advisor don’t “click,” even good advice may be hard to take.

To learn more about Shore Point Advisors, we invite you to access our Form ADV and Form CRS. We are proud to be a fiduciary, fee-based Registered Investment Advisor firm. We offer an evidence-based investment strategy guided by your highest financial interests and total wealth care.

Together, let’s explore your financial possibilities. You can reach us anytime at (732) 876-3777!

This post was written and first distributed by The Writing Company.

DISCLAIMERS

This material is intended for general public use. By providing this material, we are not undertaking to provide investment advice for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact one of our financial professionals for guidance and information specific to your individual situation. This is not an offer to buy or sell a security.

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

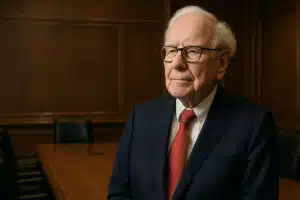

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.