10 Ways Every Entrepreneur Can Adopt an Investing Mindset

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

In our last piece, “The Human Factor in Evidence-Based Investing,” we explored how our deep-seated “fight or flight” instincts generate an array of behavioral biases that can trigger unsound investment decisions, such as buying when markets are high and selling when they are low. Here, we will familiarize you with a half-dozen additional biases, and how to recognize the signs of these behavioral traps.

Herd mentality is what happens when you see a market movement afoot, and you decide to join the stampede. The herd may be hurtling toward what seems like a hot buying opportunity, such as a run on a stock or stock market sector. Or it may be fleeing a widely perceived risk, such as a pandemic, or a country in economic turmoil. Either way, as we covered earlier in “Ignoring the Siren Song of Daily Market Pricing,” following the herd puts you on a dangerous path toward buying high, selling low and incurring unnecessary costs along the way.

Even without a herd to spur you on, your long-term plans are at risk when you give recent information greater weight than the long-term evidence warrants. From our earlier discussion in “The Business of Investing,” we know that stocks have historically delivered premium returns over bonds. And yet, whenever stock markets dip downward, we typically see recency at play as droves of investors sell their stocks to seek “safe harbor.” Vice-versa when bull markets are on a tear. Investors pile in, chasing after past returns.

Confirmation bias is the tendency to favor evidence that supports our beliefs and gloss over that which refutes it. We will notice and watch news that supports our belief structure. We will discount that which might prove us wrong. Of all the behavioral biases on this and other lists, confirmation bias may be the greatest reason why the rigorous, peer-reviewed approach we described in “The Essence of Evidence-Based Investing” is so critical to objective decision-making. Without it, your brain wants you to be right so badly, it may rig the game against your own best interests.

In “Your Money & Your Brain,” Jason Zweig describes overconfidence in action when he asks: “How else could we ever get up the nerve to ask somebody out on a date, go on a job interview or compete in a sport?”

In these and similar scenarios, a degree of overconfidence can be good. But it often becomes dangerous in investing. Overconfidence tricks us into believing we can consistently beat the market by being smarter or luckier than average. In reality, as we described in “You, the Market and the Prices You Pay,” it is best to patiently participate in the market’s expected returns, instead of trying to go for broke (potentially literally).

As a flip side to overconfidence, we also are endowed with an over-sized dose of loss aversion. In fact, academic insights suggest we dislike the thought of losing money about twice as much as we enjoy the prospect of receiving more of it.

One way that loss aversion plays out is when investors prefer to sit in cash or bonds during bear markets, or even when stocks are going up but a correction “feels” overdue. The evidence clearly suggests you are likely to end up with higher long-term returns by at least staying put in the market, if not bulking up on stocks while they are relatively cheap. But even the potential for future loss can be a more compelling stimulus than the higher likelihood of long-term returns.

We investors also have a terrible time admitting defeat. When we buy an investment and it sinks lower, we are reluctant to lose our initial stake. Anchoring, which is another bias, may convince us to avoid selling anything until we can at least recover our sunken cost.

In a data-driven strategy (and life in general), the evidence is strong that this sort of logic leads people to throw good money after bad. In the long run, it is essentially irrelevant whether an individual holding in your portfolio has gone up or down. By refusing to let go of it once it no longer suits your greater purposes, an otherwise solid investment strategy gets weighed down by emotional choices and debilitating distractions. The better question guiding when to hold and when to sell is whether or not a holding continues to make sense within your overall portfolio.

So, there you have it. Six behavioral biases, with many others worth exploring. We recommend you take the time to learn more. First, it is a fascinating field of inquiry. Second, it can help you become a more confident investor.

Following are a few of our favorite books on the subject:

The insights you will discover are likely to enhance other aspects of your life as well. But be forewarned. Even once you are aware of your behavioral stumbling blocks, it is still difficult to avoid tripping on them. By definition, your instincts fire off lightning-fast reactions in your brain well before logical thinking kicks in. This is one reason we suggest working with an objective advisor, to help you see and avoid the collisions that your own myopic vision might miss.

In the next and final installment of our Evidence Based Investment Insights, we will tie together the insights shared throughout the series. Of course, there is no need to stand on ceremony. If you have questions or ideas you would like to explore right away, please reach out to us today.

This post was written and first distributed by Wendy J. Cook.

DISCLAIMERS

This material is intended for general public use. By providing this material, we are not undertaking to provide investment advice for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact one of our financial professionals for guidance and information specific to your individual situation. This is not an offer to buy or sell a security.

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

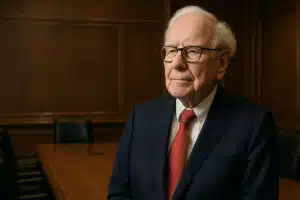

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.