10 Ways Every Entrepreneur Can Adopt an Investing Mindset

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

In our last piece, “The Essence of Evidence-Based Investing,” we explored what we mean by evidence-based investing. Grounding your investment strategy in rational methodology strengthens your ability to stay on course toward your financial goals, as we:

An accumulation of studies dating back to the 1950s through today has identified three stock market factors that have formed the backbone for evidence-based portfolio builds over time:

This is the trio of factors described in the Fama-French Three-Factor Model we discussed in “The Essence of Evidence-Based Investing.” Similarly, academic inquiry has identified two primary factors driving fixed income (bond) returns:

Scholars and practitioners alike strive to determine not only that various return factors exist, but why they exist. This helps us determine whether a factor is likely to persist (so we can build it into a long-term portfolio) or is more likely to disappear upon discovery.

Explanations for why persistent factors linger usually fall into two broad categories: risk-related and/or behavioral.

Persistent premium returns are often explained by accepting market-related risks that cannot be diversified away, in exchange for pursuing their expected rewards.

For example, it is presumed that value stocks are inherently riskier than growth stocks, relative to their underlying worth.

In “Value Premium Lives!” financial author Larry Swedroe explains:

“Among the risk-based explanations for the [value] premium are that value stocks contain a distress (default) factor, have more irreversible capital, have higher volatility of earnings and dividends, are much riskier than growth stocks in bad economic times, have higher uncertainty of cash flow, and … are more sensitive to bad economic news.”

Or, as Fortunes & Frictions financial blog author and advisor Rubin Miller describes:

“The ‘value’ is the price investors must pay for the company… Investors require lower prices to be willing to buy Turkish stocks over U.S. stocks, just as a consumer might require a lower price for buying a taco versus a pizza. The price has to clear for the purchase, and so it reflects value.”

When it comes to price-setting, there are also behavioral foibles at play. That is, our basic survival instincts often play against thoughtful reason. As such, the market may favor those who avoid acting on damaging gut reactions to breaking news.

Once we complete our exploration of market return factors, we will explore the fascinating field of behavioral finance. Suffice it to say for now, this “human factor” can contribute significantly to your ultimate success or failure as an evidence-based investor.

Factors that figure into market returns may be a result of taking on added risk, avoiding the self-inflicted wounds of behavioral biases, or a mix of both. Regardless, existing and unfolding academic inquiry on market return factors continues to hone our strategies for most effectively capturing expected returns according to your personal goals. The same inquiry continues to identify other promising factors that may augment our efforts. We will turn to those in the next installment of this series.

This post was written and first distributed by Wendy J. Cook.

DISCLAIMERS

This material is intended for general public use. By providing this material, we are not undertaking to provide investment advice for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact one of our financial professionals for guidance and information specific to your individual situation. This is not an offer to buy or sell a security.

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

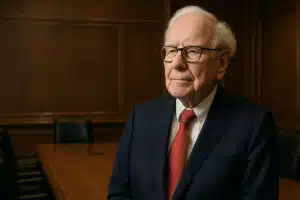

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.