10 Ways Every Entrepreneur Can Adopt an Investing Mindset

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

On the following checklist, we are going to cover key issues to consider when selling your home, such as:

Do you need to review whether you are organized and prepared for your home sale?

If so, consider what documents you need to get in order (e.g., deed, title, tax bills, utility bills, rental agreements, etc.), what professionals may need to be involved (e.g., real estate agent, attorney, appraiser, inspector, etc.), and whether any updating or staging may be necessary.

Did your home inspection identify any issues that need to be addressed?

If so, consider resolving any issues/repairs before putting your home on the market, and have a plan to address any outstanding issues with prospective buyers.

Are you considering making home improvements to increase the sale value (or competitiveness) of your home?

If so, consider whether the potential value added from improvements will outweigh the costs, and be mindful that buyers may not share the same style preferences as you. In some circumstances, reducing your home’s listing price may be more competitive than making costly improvements.

Are you considering selling your home without a real estate agent (i.e., for sale by owner)?

If so, consider whether the potential benefits (e.g., saving on commissions, control over the process, etc.) outweigh the risks (e.g., longer sale process, potentially lower sale price, etc.) before making a decision.

Do you currently have rental tenants living in your home?

If so, consider how their current lease agreement (e.g., month-to-month, fixed-term, etc.) might affect the sale process, and be sure to give your tenants plenty of notice. Depending on your circumstances, you may need to negotiate an early move-out with your tenants by offering a payout.

Do you need to review what to do after the sale of your home?

If so, consider contacting your mortgage lender and escrow company for formal verification that your remaining mortgage balance was paid off (if applicable), and your homeowners insurance provider to make sure you update your policy (e.g., cancel, transfer to new property, etc.).

Do you need to review what you’re going to do with your home sale proceeds?

If so, consider the net amount you will walk away with, and make sure to plan appropriately for any transition period (e.g., job change, temporary income shortage, etc.) or upcoming expenses (e.g., new down payment, moving costs, etc.) you may be subject to after the sale.

Did you (and/or your spouse) purchase this home?

If so, your initial cost basis is the purchase price of your home plus any applicable closing costs you paid for. If your spouse is deceased, remember to adjust your cost basis higher (i.e., a partial step-up or full step-up in basis depending on whether you live in a common law or community property state).

Did you inherit your home from someone other than your spouse?

If so, your initial cost basis is generally what the fair market value of the property was at the date of death from the person you inherited it from, or the alternative valuation date if elected (see the “Will I Receive A Step-Up In Basis For The Appreciated Property I Inherited” flowchart).

Did you receive your home as a gift or as part of a divorce settlement?

If so, your initial cost basis is generally carried over from the person you received the home from (i.e., their cost basis). Be mindful of whether the “double basis” rules apply to your situation.

Have you made any capital improvements to your home (e.g., remodeling, solar panel installation, etc.)?

If so, remember to adjust your cost basis higher by the amounts you’ve paid for capital improvements. However, be mindful to adjust your cost basis lower by the amount of any energy tax credits you may have received for energy-related home upgrades.

Have you made any repairs to your home?

If so, be mindful that most repairs do not affect your cost basis unless they are mandatory (due to damages) or are part of extensive restoration work. Be sure to adjust your cost basis higher for any repair costs that qualify.

Have you ever taken the home office deduction?

If so, remember to adjust your cost basis lower by the amount of deductions you’ve taken (only if you used the actual expense method).

Have you ever rented your home to tenants?

If so, remember to adjust your cost basis lower by the total amount of depreciation you were entitled to take. Depreciation recapture is mandatory (even if never taken) to the extent of any realized gains at sale, and is taxed up to a 25% tax rate (plus 3.8% NIIT, if applicable).

Do you need to review whether you qualify for the Section 121 exclusion (i.e., capital gains of up to $250,000, or $500,000 if MFJ) on the sale of your home?

If so, consider the following:

After considering your cost basis, are you expecting to sell your home at a loss?

If so, be mindful that you will not be able to use losses on the sale of your personal residence to offset other gains. If your home is a rental property (or an inherited property and not used as your personal residence), you may be able to recognize your loss to offset other ordinary income, but be mindful of the rules and limitations that apply.

After considering your cost basis (and any applicable capital gain exclusions), are you expecting to sell your home at a taxable gain?

If so, consider the following:

Are you selling your home to your child?

If so, be mindful of any gift tax issues if selling it below fair market value. Additionally, consider whether financing the home to your child (via a family loan) would be appropriate, but be mindful of the imputed interest rules if your interest rate is not in line with the applicable federal rates (AFR).

Do you need to review whether you will be required to report the sale of your home on your taxes?

If so, be mindful that you will need to report your home sale on your taxes if you have a gain and are not eligible to exclude all of it, if you have a gain and you choose not to exclude all of it (i.e., if you plan to use the Section 121 exclusion on another home within two years), or if you received a Form 1099-S.

This checklist was prepared and first distributed by fp PATHFINDER.

DISCLAIMERS

This material is intended for general public use. By providing this material, we are not undertaking to provide investment advice for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact one of our financial professionals for guidance and information specific to your individual situation. This is not an offer to buy or sell a security.

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

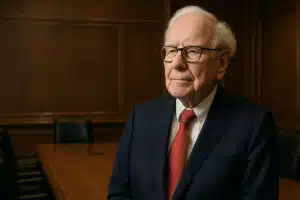

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.