Homeowners Insurance Rates Are Rising. What Does That Mean for You?

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Stock buybacks (i.e. a company repurchasing shares of its own stock) have been targets for praise and criticism through the years. So, are they good or evil? We agree with The Wall Street Journal columnist Jason Zweig, who once wrote:

“Buybacks are neither bad nor good. They are simply a tool. Just as you can use a hammer either to build a house or knock one down, buybacks are useful in the right corporate hands and dangerous in the wrong ones.”

In other words, a stock buyback can help you, hurt you or be a neutral event, depending on the particulars. Today, let’s embark on a balanced look at stock buybacks.

Before we dive into any details, let’s answer a bigger question. No matter how you may feel about stock buybacks, what should you do about them as an investor? If you are familiar with our general investment strategy, our answer will come as no surprise:

Stock buybacks give investors yet another reason to prefer widely diversifying their investing across myriad asset classes around the world, rather than trying to get ahead by deliberately picking or avoiding particular stocks or industries.

As with any stock bid, even a well-devised buyback can backfire if the future does not unfold as hoped for. It can be even worse if the buyback motives were shaky to begin with. Because we cannot predict, we advise investing across a globally diversified portfolio of low-cost mutual funds or ETFs, using fund managers who avoid engaging in market-timing or stock-picking. That way, you will continue to capture long-term market growth, including any returns generated by stock buybacks, without needing to assess each one as it occurs.

In this context, let’s look at how buybacks generally work. Even if you are not actively participating in individual stock buybacks, it is worth being informed about them, especially if you are employed at a company that may periodically offer them.

In general, you and other traders can buy or sell any publicly traded stock on an open exchange like the NASDAQ or New York Stock Exchange (NYSE). Similarly, a company can participate in these same exchanges, using its retained earnings to buy back or extend a tender offer to repurchase some of its own stock.

However, just because a company wants to buy back shares, does not mean you have to sell any of yours. A stock buyback offer is just like any other trade on the open market. Before a trade occurs, would-be buyers and sellers must agree on a fair price. (1)

There is also one noteworthy difference between a stock buyback versus simply selling stock to another trader. In a “regular” trade, one of you is the seller, and the other is the buyer. End of story. But when you own a company’s stock, you own a piece of its capital, making you a co-owner. Thus, in a stock buyback, you may have vested interests on both sides of the trade.

And that is where things get interesting. How do companies use (and occasionally abuse) stock buybacks to deliver sustainable value to its shareholders? We will explore that topic in our next piece.

This post was written and first distributed by Wendy J. Cook.

FOOTNOTE

(1) If you are invested in a mutual fund or ETF, rather than directly in individual stocks, the fund manager decides on your behalf whether to accept company buyback offers. But the principle remains the same: The buyer and seller must agree on a fair price at which to trade.

DISCLAIMERS

This material is intended for general public use. By providing this material, we are not undertaking to provide investment advice for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact one of our financial professionals for guidance and information specific to your individual situation. This is not an offer to buy or sell a security.

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

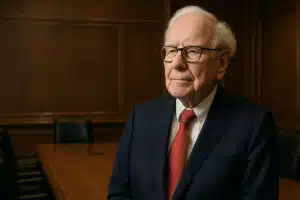

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.

Asset allocation plays an important role in an investment portfolio.