10 Ways Every Entrepreneur Can Adopt an Investing Mindset

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

Buying a home is one of the biggest financial moves you will ever make. There are a number of items to consider when buying a home, including how the costs of purchasing and owning a home will impact your overall financial planning goals.

On the following checklist, we cover financial issues you need to consider when buying and owning a home, including:

Do you need help determining how much it will cost to own and maintain your new home?

If so, consider the following expenses:

Will you be making changes/improvements to the property (such as a renovation or addition)?

If so, consider how those future expenses will impact your financial situation.

Will this purchase impact your ability to save for other goals (such as retirement)?

If so, consider prioritizing your goals and understanding the tradeoffs with each decision.

Do you have a spouse or partner, and do you currently or plan to live on one income (e.g., so that one parent can stay home with children)?

If so, consider how the new home and carrying costs fit within your budget, and make adjustments accordingly.

Will you be living in the home for five years or fewer?

If so, consider doing a break-even analysis to see if it may be more practical to rent rather than own.

Do you need assistance in considering the financial impact of different types of mortgages?

If so, consider the following:

Did you serve in the military?

If so, you may be eligible for a VA Home Loan, which may offer a lower interest rate.

Do you need assistance in evaluating competitive interest rates?

Are you working and will your total monthly mortgage payment (P&I, taxes and insurance) be 28% or more of your gross monthly income?

If so, some lenders may not be willing to lend money to you.

Are you retired and you have no earned income?

If so, lenders may look at your portfolio value and/or your portfolio withdrawals to determine eligibility. Pensions and Social Security may also be taken into consideration.

If you have other long-term debts, will the total monthly debt payment (including the future mortgage) be 36% or more of your gross monthly income?

If so, some lenders may not be willing to lend money to you.

Do you have a low credit score or poor credit history?

If so, consider the following:

Do you anticipate making any large purchases, opening new credit cards, or closing existing credit cards in the months leading up to the purchase of your home?

If so, consult with your lender to ensure that it does not impact your credit score or loan application.

Do you need help determining closing-related costs (e.g., appraisals, loan origination fees, processing fees, points, attorney fees)?

Do you need assistance in determining how much of a down payment should be made?

If so, consider the following:

Do you lack liquidity and need assistance in determining how to fund the down payment?

If so, consider the following:

Will property and state income taxes exceed $10,000?

If so, you will not be able to deduct any amount over $10,000.

Will the mortgage debt exceed $750,000?

If so, you will not be able to deduct the interest on the debt exceeding $750,000.

Will you use part of your home for the principal place of your business?

If so, consider the home office deductions. Office space must be used exclusively for business purposes.

Do you plan on making improvements to the property?

If so, consider tracking the cost of improvements, as they can be added to the cost basis, reducing gains if you eventually sell your home.

Should the home be owned by one spouse or owned by a trust?

If so, consider the following:

Is this a second home or a rental property?

If so, consider how it should be titled, any potential liabilities, and the possible use of an LLC.

Will your need for life insurance change in light of a new mortgage?

Will you need to review your home and auto policy?

There may be cost savings by bundling with one carrier.

Will you need an umbrella policy or need to increase the limits if one is already owned?

Are there any state-specific issues that should be considered?

If so, some states offer state tax benefits for homeowners.

Is this home purchase a result of an employment change?

If so, you may be eligible for relocation assistance from your employer.

This checklist was prepared and first distributed by fp PATHFINDER.

DISCLAIMERS

This material is intended for general public use. By providing this material, we are not undertaking to provide investment advice for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact one of our financial professionals for guidance and information specific to your individual situation. This is not an offer to buy or sell a security.

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

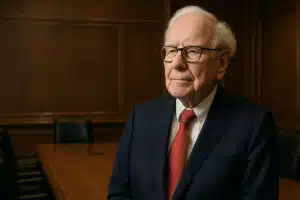

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.