10 Ways Every Entrepreneur Can Adopt an Investing Mindset

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

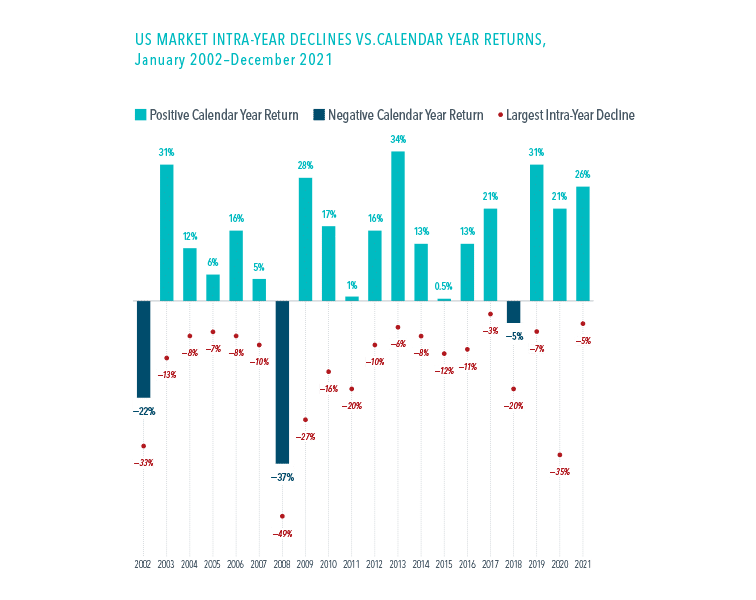

Stock market declines over a few days or months may lead investors to anticipate a down year. But the US stock market had positive returns in 17 of the past 20 calendar years, despite some notable dips in many of those years.

Past performance is no guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

In US dollars.

Data is calculated off rounded daily returns. US Market is represented by the Russell 3000 Index. Largest Intra-Year Decline refers to the largest market decrease from peak to trough during the year. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes.

Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful.

This post was prepared and first distributed by Dimensional Fund Advisors.

Shore Point Advisors is an investment adviser located in Brielle, New Jersey. Shore Point Advisors is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Shore Point Advisors only transacts business in states in which it is properly registered or is excluded or exempted from registration. Insurance products and services are offered through JCL Financial, LLC (“JCL”). Shore Point Advisors and JCL are affiliated entities.

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.