Don’t Get Fed Up

Fed watching is an unreliable input into investment decisions because the Fed’s expected actions are already reflected in market prices.

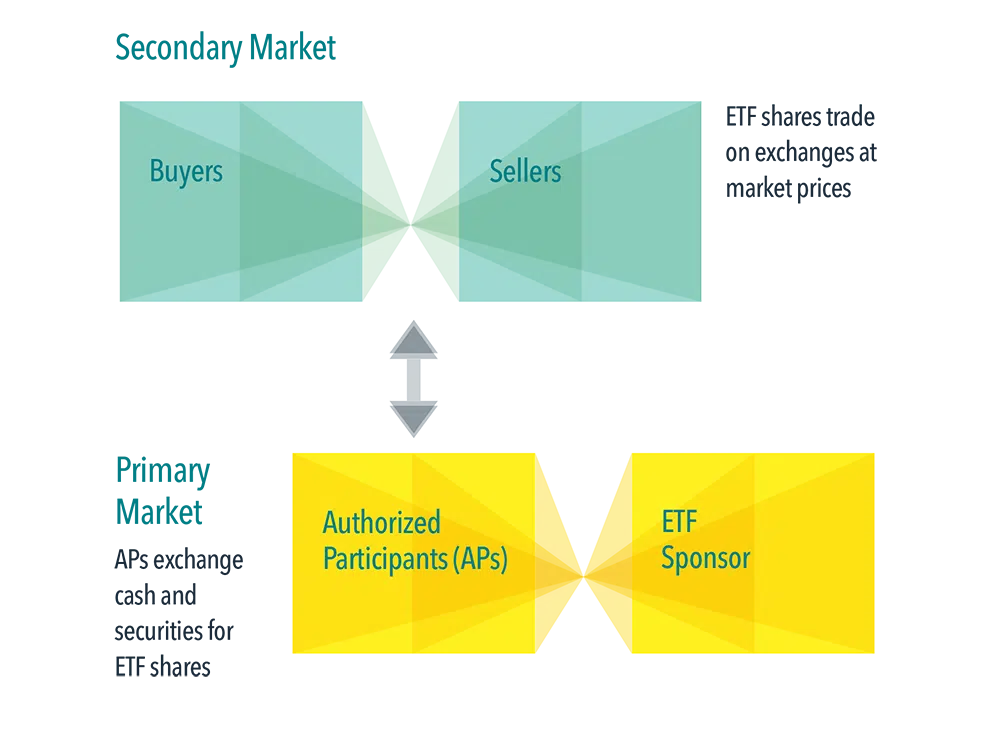

Exchange-traded funds (ETFs) offer investors an efficient means of accessing a professionally managed portfolio of securities through a single investment vehicle. While ETFs share this and many other features with mutual funds, the process of buying and selling ETF shares is different.

Similar to trading a stock, investors can buy and sell ETF shares on a national stock exchange at a market price that can change throughout the day. These trades occur on the secondary market.

New shares of an ETF are created when an ETF sponsor, such as Dimensional, and an approved financial institution, referred to as an Authorized Participant (AP), transact in the primary market. When there is high demand for ETF shares, an AP can request new shares from the ETF sponsor in exchange for securities and cash. To redeem shares of the ETF, the AP can deliver ETF shares to the ETF sponsor in exchange for securities and cash. This plays an important role in balancing the supply and demand for shares of an ETF.

ETF trading across primary and secondary markets helps support the daily demand for ETF shares, providing multiple layers of liquidity to investors. (1)

DEFINITIONS

Primary Market: The market for creating new or redeeming existing ETF shares, which is facilitated by trades between an authorized participant and an ETF sponsor.

Secondary Market: The market where previously issued ETF shares are bought and sold, often on exchanges.

DISCLOSURES

(1) Multiple layers of ETF liquidity refers to liquidity available in the secondary market and that can be generated in the primary market through ETF share creation and redemption activity between APs and an ETF sponsor. This is unlike an individual stock, which generally has a fixed supply of shares in the secondary market. An AP may request to create or redeem ETF shares in order to provide liquidity to large ETF orders or to help balance supply and demand for ETF shares on the secondary market.

Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the Dimensional funds, please read the prospectus carefully before investing. Prospectuses are available by calling Dimensional Fund Advisors collect at (512) 306-7400 or at us.dimensional.com. Dimensional funds are distributed by DFA Securities LLC.

ETF shares trade at market price and are not individually redeemable with the issuing fund, other than in large share amounts called creation units. Investing involves risk, including the possible loss of principal and fluctuation of value.

This post was prepared and first distributed by Dimensional Fund Advisors.

Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

Fed watching is an unreliable input into investment decisions because the Fed’s expected actions are already reflected in market prices.

Ask investors what kind of return they expect out of stocks in any given year, and many will say the market’s historical average return.

During a presidential election year, investors tend to seek a connection between who wins the White House and which way stocks will go.

What do you do if you receive a big bonus at work, inherited some money or enjoyed a recent windfall you would like to invest?