Homeowners Insurance Rates Are Rising. What Does That Mean for You?

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

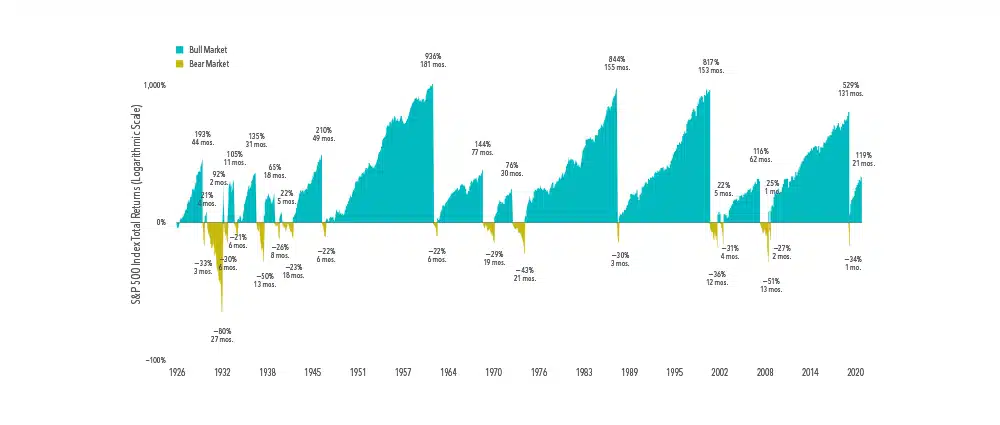

S&P 500 Index Total Returns (January 1926 – December 2021)

Stock returns are volatile, but nearly a century of bull and bear markets shows that the good times have outshined the bad times.

The stock market’s ups and downs are unpredictable, but history supports an expectation of positive returns over the long term. For the best shot at the benefits the market can offer, stay the course.

This post was prepared and first distributed by Dimensional Fund Advisors.

Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

In USD. Chart end date is 3/31/2020, the last peak to trough return of −23% represents the return through March 2020. Due to availability of data, monthly returns are used January 1926 through December 1989; daily returns are used January 1990 through present. Periods in which cumulative return from peak is −20% or lower and a recovery of 20% from trough has not yet occurred are considered Bear markets. Bull markets are subsequent rises following the bear market trough through the next recovery of at least 20%. The chart shows bear markets and bull markets, the number of months they lasted and the associated cumulative performance for each market period. Results for different time periods could differ from the results shown. A logarithmic scale is a nonlinear scale in which the numbers shown are a set distance along the axis and the increments are a power, or logarithm, of a base number. This allows data over a wide range of values to be displayed in a condensed way.

Source: S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.

Asset allocation plays an important role in an investment portfolio.