Should You Consolidate Your Retirement Accounts?

Should you consolidate retirement accounts? Learn the benefits, potential drawbacks, and key factors to consider before making a move.

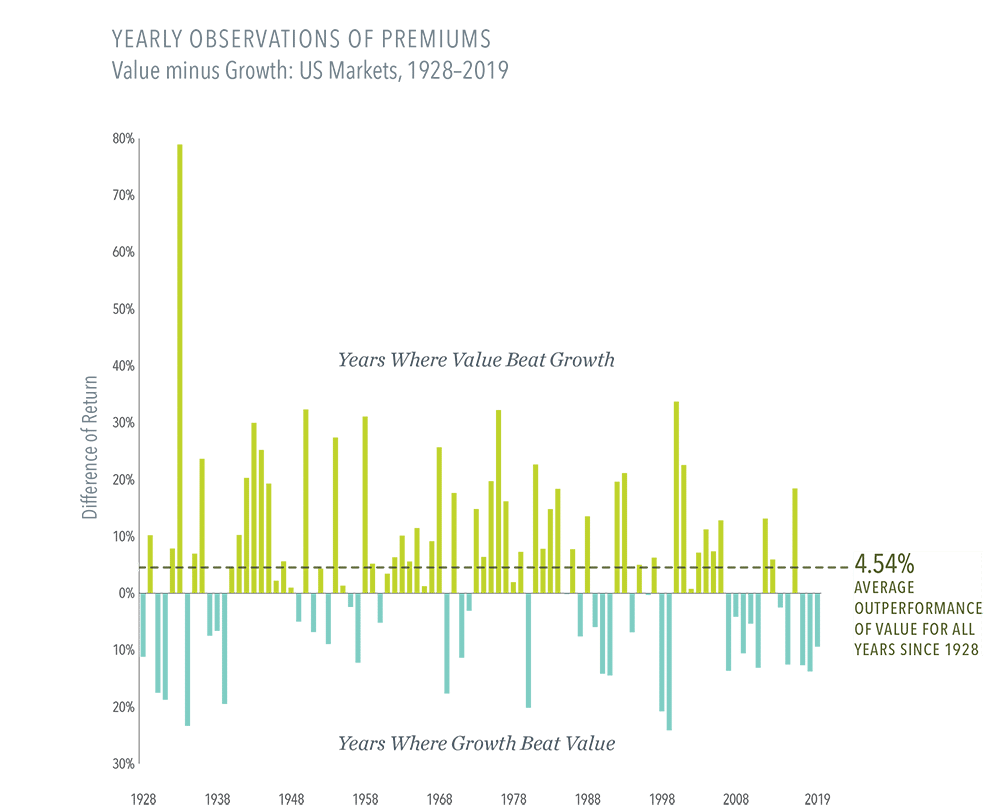

Historically, value stocks have outperformed growth stocks in the United States, though recently that hasn’t been the case. While disappointing periods emerge from time to time, the principle that lower relative prices lead to higher expected returns remains the same.

Logic and history argue for a commitment to value stocks, so investors can be positioned to take part when those shares outperform in the future.

This post was prepared and first distributed by Dimensional Fund Advisors.

Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

Should you consolidate retirement accounts? Learn the benefits, potential drawbacks, and key factors to consider before making a move.

Reviewing estate planning documents is an important exercise, but it can be a daunting task that is tedious and even confusing at times.

Explore the role of financial media in investing and how to avoid emotional, headline-driven decisions.

Asset location should not be confused with asset allocation. The two are related, but different, portfolio management techniques.