10 Ways Every Entrepreneur Can Adopt an Investing Mindset

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

There is a famous saying that “you don’t rise to the occasion, you sink to the level of your training.”1 The implication is that, in times of great stress, the most reliable recipe for success is sticking to a set of fundamental principles.

From February 20 to March 20, the S&P 500 Index returned –37.4%, with daily returns ranging from –12.0% to +9.4%. A drop of nearly 40% in the stock market combined with a spike in volatility can make many investors reconsider their investment approach. Some might suddenly find stock-picking approaches more alluring. After all, who has not heard the claim that a volatile market is precisely the environment in which many traditional active managers thrive? But is there any truth to this claim?

To explore this issue, we looked at the performance of active US mutual fund managers over the past two decades. We considered two different ways of measuring stock market stress: market volatility (or how much stocks rise or fall in a given month) and return dispersion (or the range of returns across all US stocks). In each case, active managers underperformed their index benchmarks.

Average Excess Monthly Returns for Active US Equity Mutual Funds

1/1999—12/2019

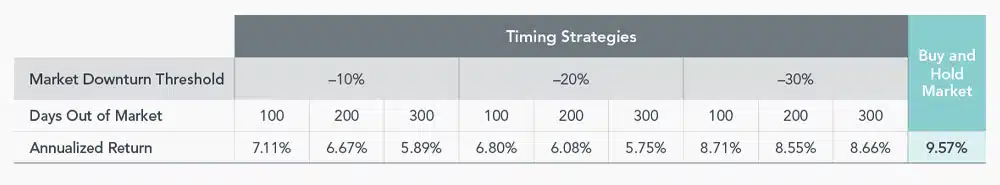

Another way some investors might react to a falling market is jumping ship and selling out of stocks. The intuition may be that sitting out of the market for a period of time can help avoid further losses. However, the data suggest this type of market timing may instead reduce investors’ gains over time. Exhibit 2 illustrates this point using hypothetical timing strategies that switch from US stocks into US Treasury bills after market downturns of various magnitude and switch back to US stocks following different lengths of time out of the market. Compared to the market’s long-term annualized return of 9.57%, nearly all of the timing strategies underperform the simple buy-and-hold strategy.

Hypothetical Timing Strategies Withdrawing from US Stocks After Downturns

US Stocks, 7/1926—12/2019

Should these results be surprising? One of the challenges with trying to outguess markets is the unpredictable nature of outcomes. For example, how many pundits would have expected the equity market in China, ground zero for the COVID-19 outbreak, to outpace global equities2 by over 10% year to date, as of March 31?

Financial downturns are unpleasant for all market participants. Investors can reduce exacerbating the experience by adhering to core principles. Two such principles supported by a long history of research are broad diversification and maintaining a consistent asset allocation. Investors who deviate from these principles by pursuing stock picking or market timing may undermine their ability to achieve their investment goals.

EXHIBIT 1

Sample of active managers consists of mutual funds categorized as active US equity by Morningstar. Fund returns are average returns computed each month, with individual fund observations weighted in proportion to their assets under management (AUM). Index benchmarks are those assigned by Morningstar based on the fund’s Morningstar category. Benchmark returns used in the excess return calculation are averages computed each month by weighting in proportion to each fund’s AUM. The sample period is split into two groups: months with standard deviation of daily returns in the top half and bottom half (left panel) and months with cross-sectional stock return dispersion in the top and bottom half (right panel). Daily returns used for standard deviation calculation are from the Fama/French Total US Market Research Index. Cross-sectional dispersion computed across all US common stocks. Details on the index can be found on Ken French’s website: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

EXHIBIT 2

Performance shown is hypothetical and for illustrative purposes only. The performance was achieved with the retroactive application of a model designed with the benefit of hindsight; it does not represent actual performance and it does not take into account any individual investor circumstances. Hypothetical performance does not reflect trading in an actual portfolio and may not reflect the impact that economic and market factors may have had on trading decisions.

Market represented by Fama/French Total US Market Research Index. Details on the index can be found on Ken French’s website: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. Downturns are defined as the first instance of a cumulative return meeting the -10%, -20%, or -30% threshold following a day when the index has reach’s a new all-time high level. Timing strategies switch from the US stock market (represented by the Fama/French Total US Market Research Index) to One-Month US Treasury Bills (represented by the IA SBBI US 30 Day TBill TR USD provided by Ibbotson Associates via Morningstar Direct) following each downturn and switch back to the market following the number of trading days denoted. Past performance is not a guarantee of future results. No costs included.

FOOTNOTES

1www.phillymag.com/birds247/2014/10/10/inside-voices-practice-versus-training/

2China equities represented by MSCI China IMI Index (net div., USD). Global equities represented by MSCI All Country World IMI Index (net div., USD).

This post was prepared and first distributed by Dimensional Fund Advisors.

Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.