3 Lessons from Investing’s “Moneyball” Moment

What can investors learn from Moneyball? Discover three lessons from 100 years of stock market data about discipline, markets, and long-term returns.

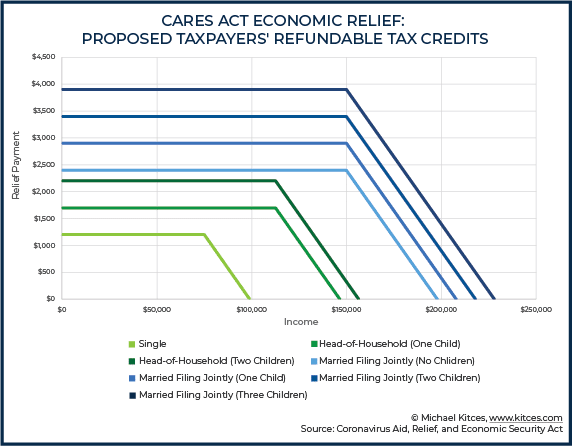

With much of the country in self-isolation, perhaps you’ve had time to read the entire H.R. 748 Coronavirus Aid, Relief, and Economic Security Act, or CARES Act. If you’d prefer, here is a summary of many of the key provisions we expect to be discussing with you in person (virtually), depending on which ones apply to you. If you have any questions after reading this, give us a call at (732) 876-3777.

Now you’re caught up on the critical content of the CARES Act. That said, given the complexities involved and unprecedented current conditions, there will undoubtedly be updates, clarifications, additions, system glitches, and other adjustments to these summary points. The results could leave a wide gap between intention and reality.

As such, before proceeding, please consult with us and other appropriate professionals, such as your accountant, and/or estate planning attorney on any details specific to you. Please don’t hesitate to reach out to us with your questions and comments. It’s what we’re here for.

This post was prepared and first distributed by Wendy J. Cook.

Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

What can investors learn from Moneyball? Discover three lessons from 100 years of stock market data about discipline, markets, and long-term returns.

Reviewing your investment portfolio is a critical part of the financial planning process. This checklist covers some key topics to consider.

Learn more about the Core Four legal documents help ensure your wishes are honored if you become incapacitated.

There are issues to consider when buying a home, including how the costs of purchasing and owning a home will impact your financial goals.