Finding Your Fiduciary Financial Advisor

When you are selecting or retaining a financial advisor, how do you know if you are making the best choice?

Is the market getting by with a little help from the FAANGs? And does their performance stand out historically? Investors may be surprised that it’s common for a subset of stocks to drive a sizable portion of market returns.

The stocks commonly referred to by the FAANG moniker—Facebook, Amazon, Apple, Netflix, and Google (now trading as Alphabet)—have posted impressive gains through the years, with all now worth many times their initial-public-offering prices. The notion of FAANG stocks as a powerful group holding sway over the markets has sunk its teeth into some investors. But how much of the market’s recent returns are attributable to FAANG stocks? And does their performance point to a change in the markets?

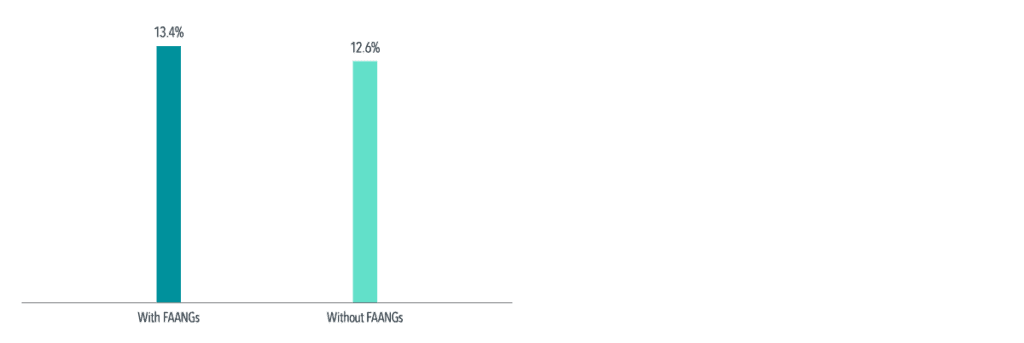

Over the 10 years through December 31, 2018, the US broad market1 returned an annualized 13.4%, as shown in Exhibit 1. Excluding FAANG stocks, the market returned 12.6%. The 0.8-percentage-point bump resulted from the FAANGs collectively averaging a 30.4% yearly return over the decade.

Source: Dimensional using data from the Center for Research in Security Prices (CRSP) covering the 10 calendar years since the financial crisis. With FAANGs portfolio formed each month including common stocks listed on NYSE, NYSE MKT, and NASDAQ. Stocks are weighted by market capitalization. Without FAANGs formed similarly but excluding Facebook, Apple, Amazon, Netflix, and Alphabet (Google). Past performance is no guarantee of future results.

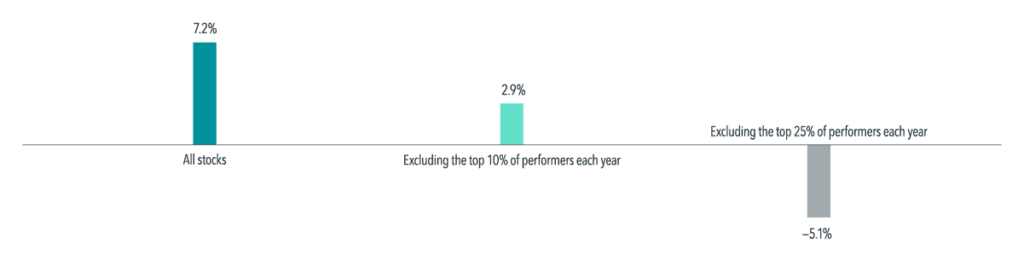

Investors may be surprised to learn that it is actually common for a subset of stocks to drive a sizable portion of the overall market return. Exhibit 2 shows that excluding the top 10% of performers each year from 19942 to 20183 would have reduced global market performance from 7.2% to 2.9%. Further excluding the best 25% of performers would have turned a positive return into a relatively large negative return.

Exhibit 2: Weighing the Impact

Global stock market performance excluding top performers, 1994–2018

“All stocks” includes all eligible stocks in all eligible developed and emerging markets at their market cap weights. Eligible stocks are required to meet a minimum market capitalization requirement. REITs and investment companies are excluded. Compound average annual returns are computed as the compound returns of the value-weighted averages of the annual returns of the included securities. “Excluding the top 10%” and “Excluding the top 25%” are constructed similarly but exclude the respective percentages of stocks with the highest annual returns by security count each year. Individual security data are obtained from Bloomberg, London Share Price Database, and Centre for Research in Finance. The eligible countries are: Australia, Austria, Belgium, Brazil, Canada, Chile, China, Colombia, Czech Republic, Denmark, Egypt, Finland, France, Germany, Greece, Hong Kong, Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Republic of Korea, Malaysia, Mexico, Netherlands, New Zealand, Norway, Peru, Philippines, Poland, Portugal, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, the UK, and US. Diversification does not eliminate the risk of market loss. Past performance is no guarantee of future results.

This lesson also applies to capturing the premiums associated with a company’s size and its price-to-book ratio. Research by Eugene Fama and Kenneth French (“Migration,” 2006) provides evidence that these premiums are driven in large part by a subset of stocks migrating across the market.

Research has shown no reliable way to predict the top-performing stocks. Looking at the top 10% of stocks by performance each year since 1994, on average less than a fifth of that group has ranked in the top 10% the following year.

The tendency for strong market performance to be concentrated in a subset of stocks is therefore also a cautionary tale about the importance of diversification—investors with concentrated portfolios may actually miss out on the very stocks that deliver the best of what the market has to offer. An investment approach built around broad diversification can help achieve a more reliable outcome for investors over the long term—sharp acronym or not.

This post was first distributed by Dimensionsal Investing. View the original post online.

Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

When you are selecting or retaining a financial advisor, how do you know if you are making the best choice?

Equity compensation can provide a big financial boost, but it is important to manage it by balancing potential risks and rewards.

In the second part of this young investor series, we discuss three more investment concepts every young investor may want to embrace.

If you are new to investing, it can be tough to know where to get started. There is so much information and advice out there.