10 Ways Every Entrepreneur Can Adopt an Investing Mindset

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

In order to get a better understanding of the relationship, we at Shore Point Advisors suggest that investors ask these important questions of their financial advisor.

Are you a registered financial advisor?

Shore Point Advisors is an independent registered investment advisor, meaning we are not affiliated with a broker-dealer. As a fiduciary, we have a legal obligation to put the client’s best interests first, including before our own compensation.

What is your philosophy when it comes to investing?

Shore Point Advisors utilizes the Five-Factor Model to develop portfolios allocated between equities and fixed income, small and large equities, and value and growth equities in each of the Shore Point Advisors investment models.

The Five-Factor Model

Fee Transparency: How do you get paid?

Shore Point Advisors are fee-based advisors receiving a percentage of the account balance or assets under management. We also offer financial planning for a flat fee.*

Are you an investor coach?

Shore Point Advisors serves as an investor coach, which is a financial professional who goes beyond typical financial planning and advice to help identify your investment philosophy and understand your investment strategy. Most importantly, we provide encouragement and discipline throughout your investment experience.

How will our relationship work?

Shore Point Advisors takes a team approach to our financial planning processes. Each of our professionals shares consistent beliefs in our investment philosophy to ensure that your account is managed seamlessly within our firm.

What would happen if my investor coach could no longer manage my account?

With your consent, the Shore Point Advisors Succession Plan would allow for your account to be managed by another member of our team with the same investment philosophy.

* Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements.

Asset Allocation Services

We charge either a fixed fee or an hourly rate for asset allocation services. The applicable fee is negotiated with the client and determined in advance of services rendered.

Financial Planning and Consulting Services

We charge a fixed fee or hourly fee for financial planning services. Our fixed fee generally ranges between $150 – $500, and our hourly fee is $250.

Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

Discover an investing mindset every entrepreneur can use to build wealth, manage risk and grow with confidence.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

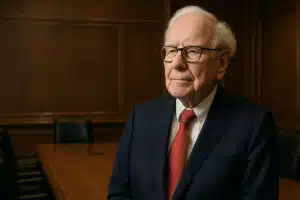

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.