Finding Your Fiduciary Financial Advisor

When you are selecting or retaining a financial advisor, how do you know if you are making the best choice?

This post was first distributed by Dimensionsal Investing. View the original post online.

There’s a misconception in the markets: value stocks have lost their vigor.

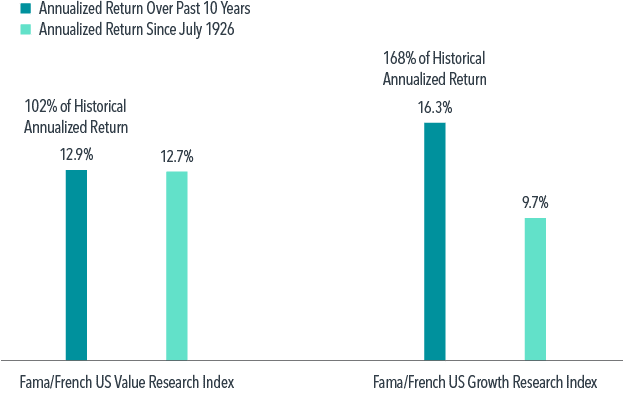

Value stocks have underperformed growth stocks over the past decade. In the US, the annualized compound return has been 12.9% for value stocks, or those trading at a low price relative to their book value. That contrasts with 16.3% annualized compound return for growth stocks, or those with a high relative price.1

Value underperforming growth by 3.4 percentage points a year over a decade is indeed disappointing. But one question investors might ask themselves is, how do the returns for value and growth stocks over the past decade compare with their long-term averages?

Looking at returns for the US value and growth indices separately in Exhibit 1, we see that growth’s annualized compound return of 16.3% over the 10-year period ending June 2019 was much higher than its return since July 1926, at 9.7%. On the other hand, value performance over the past decade has been more or less in line with its historical average: 12.9% vs. 12.7%. We can see value has performed similarly to how it has historically behaved. It is growth stocks that have had very good recent returns relative to the long-term history. Investors maintaining an emphasis on growth stocks may be hoping this departure from the trend will endure, despite the historical long-term averages.

Exhibit 1: Outlier Detector

Performance of US value stocks in past 10 years and since 1926, and performance of US growth stocks over the same periods

As of June 30, 2019. In US dollars. Fama/French indices provided by Ken French. See Index Descriptions in the appendix for descriptions of Fama/French index data. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.

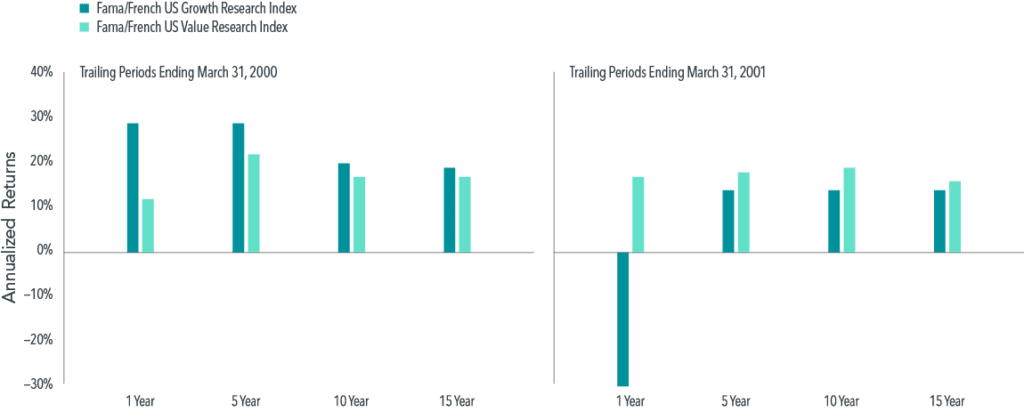

While stock returns are unpredictable, there is precedent for the value premium turning around quickly after periods of sustained underperformance. For example, some of the weakest periods for value stocks when compared to growth stocks have been followed by some of the strongest (see Exhibit 2). On March 31, 2000, growth stocks had outperformed value stocks in the US over the prior year, prior five years, prior 10 years, and prior 15 years. As of March 31, 2001—one year and one market swing later—value stocks had regained the advantage over every one of those periods.

Exhibit 2: Leap Year

Using March 31, 2000, and March 31, 2001, as ending points, performance of US value and US growth stocks over 1- to 15-year trailing periods

In US dollars. Fama/French indices provided by Ken French. See Index Descriptions in the appendix for descriptions of Fama/French index data. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.

The theoretical support for value investing is longstanding—paying a lower price means a higher expected return. However, realized returns are volatile. A 10-year negative premium, while not expected, is not unusual.

But history also tells us that changing course after a disappointing spell for known premiums can lead to missed opportunities. When those drivers of outperformance have turned around in the past, steadfast investors have been rewarded. A key to successful long-term investing is sticking with your approach, even through difficult periods, so that you are there for the good times too.

Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

When you are selecting or retaining a financial advisor, how do you know if you are making the best choice?

Equity compensation can provide a big financial boost, but it is important to manage it by balancing potential risks and rewards.

In the second part of this young investor series, we discuss three more investment concepts every young investor may want to embrace.

If you are new to investing, it can be tough to know where to get started. There is so much information and advice out there.