Homeowners Insurance Rates Are Rising. What Does That Mean for You?

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

The good news for parents and their college-bound kids: The U.S. Department of Education’s Free Application for Federal Student Aid (FAFSA®) makes it relatively easy to apply for federal and state, and many institutions’ financial aid opportunities in a single session. This “one-stop shopping” certainly beats having to submit separate applications for each source of funding!

The catch? While you are generally required to submit your FAFSA application for the 2020–2021 academic year by June 30, 2020, you are permitted to do so any time after October 1, 2019. If you’re busy with a million other things – and who isn’t? – you might be tempted to let your application slide until, say, after the holidays. We caution against doing so. The sooner you apply for FAFSA after October 1, the more likely your efforts will pay off.

As reported recently by SavingforCollege.com publisher and VP of Research Mark Kantrowitz, “Students who file the FAFSA during the first three months tend to get twice as much grants, on average, as compared with students who file the FAFSA later.”

This caveat applies to the federal level on down. “While federal student loans and the Federal Pell Grant function like an entitlement, federal campus-based aid is more limited,” says Kantrowitz. For example, federal funds for work-study programs and other opportunities come from a single “pie,” which can end up being consumed before late-comers arrive at the table.

In addition, many states operate on a first come, first served basis. These states begin granting their awards after October 1, until the funds are gone. Other states have application cut-offs earlier than June 30, again warranting a timely FAFSA application to qualify for their funds.

Considerable time is given to complete the application, check the specific requirement here. But there’s very little reason to wait so long. Similarly, individual colleges may have earlier deadlines if you would like to be given “priority consideration” for their own financial aid funds.

In short, this is one window of opportunity worth leaping through as soon as it opens. To hit the ground running, you don’t need to wait to obtain or renew your FSA ID, which will facilitate completing your FAFSA application as soon as October 1 arrives.

Before we wrap, we’ll add one more caveat from the Department of Education’s FAFSA application instructions. As the DOE emphasizes:

“One thing you don’t need for the FAFSA® form is money! The FAFSA form is FREE, so if a website or mobile app asks you to pay to fill it out, you’re not dealing with the official FAFSA site or the official myStudentAid app.”

That’s a critical point – don’t get duped into paying a FAFSA application fee.

Please let us know if you could use additional assistance as you plan for your children’s higher education funding. Given the costs involved, a well-crafted strategy can pay for itself many times over.

Shore Point Advisors is registered as an investment adviser with the State of New Jersey. Shore Point Advisors only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Past performance is not indicative of future returns. All investment strategies have the potential for profit or loss. There are no assurances that an investor’s portfolio will match or outperform any particular benchmark. Content was prepared by a third-party provider. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. All expressions of opinion reflect the judgment of the authors on the date of publication and are subject to change.

Homeowners insurance rates are climbing fast. Learn what’s driving the surge and how it could impact you.

Explore how inflation-protected bonds compare to nominal bonds, and what investors should consider when hedging against inflation.

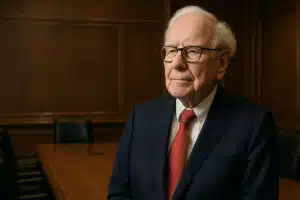

Throughout his career, Warren Buffett has shared some of the secrets to his success. Here are some of our favorite insights.

Asset allocation plays an important role in an investment portfolio.